Let’s start with a few definitions.

What Does Liquidity Refer To?

Liquidity refers to how fast you can convert an asset to cash without affecting the price of the asset.

A house is considered an illiquid asset since it takes a relatively long time between making a decision to sell and actually getting paid a fair price.

Stocks on the other hand are considered liquid because sell decisions can be executed instantly.

What Are Liquidity Pools?

Liquidity pools are pools of tokens (typically cryptocurrencies) that are used to make swap requests more liquid i.e. execute faster.

People who pool their tokens in liquidity pools are called Liquidity Providers ("LPs" for short).

Liquidity Providers receive a share of the transaction fees the pool generates and their share of these fees is proportional to the amount of tokens they added to the liquidity pool.

Adding tokens to a liquidity pool and collecting a share of the transaction fees is known as Liquidity Mining.

Are the Fees Earned by Liquidity Providers Riba?

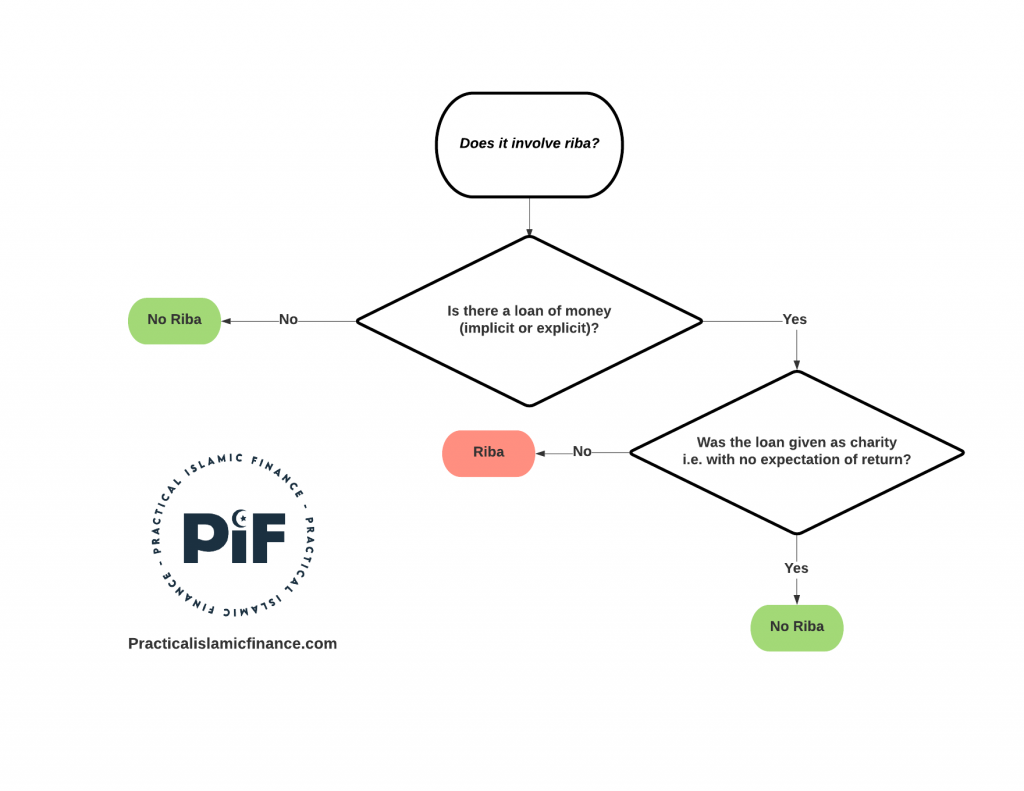

I’ve covered in previous videos and articles on this blog my formula for detecting riba in any transaction.

This formula can be summarized with the following graphic:

So the first question to ask when trying to ascertain if there is riba in liquidity mining is: Does Liquidity Mining involve a loan of money (implicit or explicit)?

The simple answer is no. It doesn't.

Let me explain...

Consider a Bitcoin-Ethereum liquidity pool.

Let's say the price of 1 Bitcoin is 10 times the price of 1 Ethereum.

You add 10 Ethereum and 1 Bitcoin to the Bitcoin-Ethereum Liquidity pool at Time = 0.

At Time = 1 the price of 1 Bitcoin becomes 40 times the price of 1 Ethereum. At this point you decide to remove your liquidity from the pool.

When you remove your liquidity from the liquidity pool, your share of the pool has changed to 0.5 Bitcoin and 20 Ethereum because of the ratio change between the price of Bitcoin and the price of Ethereum.

Since you are not entitled to, at minimum, the principal number of either token which you contributed to the liquidity pool, there was no loan of either token between you and the liquidity pool.

Additionally, in dollar terms (or any other currency for that matter) the value of the cryptocurrencies you withdraw will likely be very different than what you deposited.

Further still, it may turn out that just holding your tokens and not adding them to the liquidity pool would have been more profitable for you due to something called Impermanent Loss (see video linked above for detailed explanation of Impermanent Loss).

So there is no loan in terms of dollars or any other currency either.

What you contribute could be greater than or less than what you end up entitled to without the contract between you and the liquidity pool being in default.

Since there is no loan, there is no riba.

Conclusion: Liquidity Mining Halal or Haram?

With Liquidity Mining a service is being provided i.e. providing liquidity for token exchanges, the money of liquidity providers is being put at risk in order to provide this service, and the liquidity providers are being compensated for putting their money at risk to provide this service with the transaction fees they collect.

This seems legitimate to me and not in violation of any sharia restrictions.

Accordingly, I find Liquidity Mining to be Halal.

Keep in mind I am talking specifically about Liquidity Mining. I am not referring to Yield Farming which includes a lot of other stuff. I'm also not talking about Liquidity Pools wherein the funds in the pool are used to make loans and the Liquidity Providers share in the interest collected from these loans. Collecting fees from a liquidity pool that is making loans would obviously be a form of prohibited riba.

And Allah knows best.

Assamualikum, brother. Thank you for your detailed explanation.

So from my understanding, providing liquidity on an AMM like Uniswap on a 50-50 liquidity pool is permissible. And after giving liquidity, you take the LP tokens (like a receipt of providing liquidity) and deposit that to that project's website to get a new token (that's the project's token as a reward for the contributions and making its pair more liquid). There's no borrowing or lending as well, and they are rewarding you for taking the impermanent loss risk. That shouldn't be considered as riba as well.

Please do check whenever you get a chance. Thank you