Summary: Inflation is on the rise and it's eating at your savings. Luckily there is a straightforward solution.

As a child of the 90s, I could get a can of soda out of a vending machine for 50 cents. A pack of chewing gum cost only 25 cents. Now these simple luxuries cost more than double my childhood prices. This general rise in the price of goods and services is known as “inflation”.

Recently, inflation has been rising rapidly. The average inflation rate in the US for 2020 was about 1.24%; by June of 2021, inflation surpassed 5%. This means that, on average, $100 in 2020 could buy what you need $105 to buy in 2021. You can probably think of plenty of examples from your personal life where prices have risen, whether it’s rent, groceries, or a cup of coffee at your favorite cafe.

Now for the $64,000 question: How can we protect our money from the eroding power of inflation?? The short answer: Investing.

If you were to sell your stocks today, the purchasing power per dollar for that cash won’t be as strong as it was, say, five years ago. However, since your stocks are hopefully worth more dollars now, your overall purchasing power should be more.

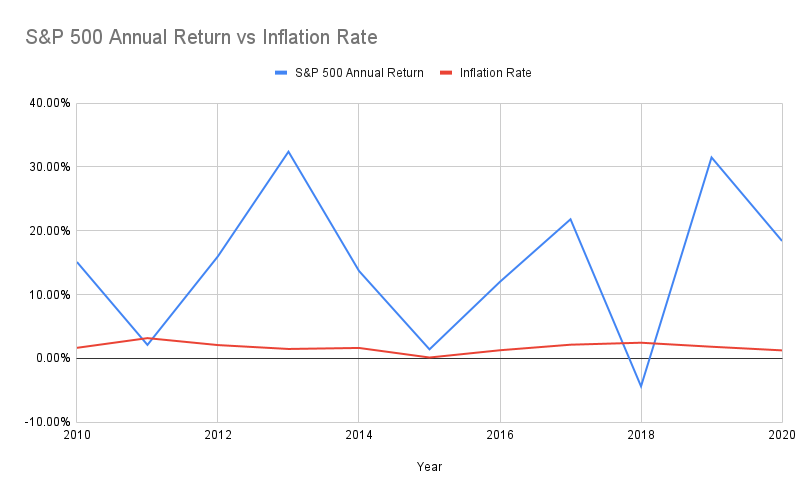

Historically, the stock market has been a great protection against inflation. Higher costs are normally passed onto consumers, so the companies you’re investing in should generally experience growth in their revenues which drives up their stock prices. As you can see from the chart below, the stock market generally exceeds the rate of inflation, sometimes by a large margin.

Stocks are not the only viable hedge against inflation. You can hedge against inflation by investing in things that appreciate in value or have a parallel effect with inflation such as raw materials. Other inflation hedge examples include real estate and commodities.

The only way to combat inflation is to cause the supply of your money to grow faster than inflation causes it to lose purchasing power. Hence the necessity of investing.

As legendary investor Ray Dalio famously said: “Cash is trash”.

Important Disclaimers:

Nothing in this article is meant to be understood as personalized financial advice.

Investing involves risk, including possible loss of principal.

Hey Farhan,

Thanks for writing on this topic. I am curious how does one protect against inflation whilst minimizing risk? Given that prices continually rise YOY, is it haram to earn interest on a savings account (which is risk free) vs putting money into the stock market (may or may not go down)?