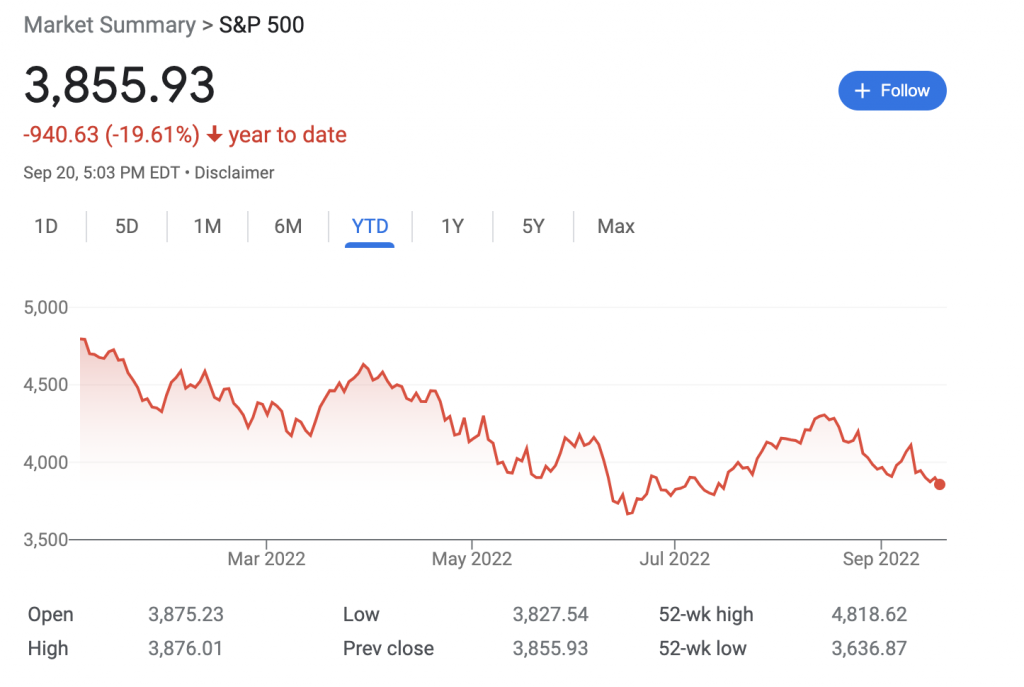

The S&P 500 is down nearly 20% since the start of the year.

The question investors often grapple with during tumultuous times like these is:

Where to Invest During Market Turmoil?

What are the best things to buy? Oil? Gold? Growth? Value?

To answer the question of how to trade the news, I’m going to share a few observations that have informed my judgment over the years…

John Maynard Keynes was an influential English economist whose ideas fundamentally changed the economic policies of governments, especially in the first half of the 20th century.

He observed that shares of ice companies were higher in the summer months when sales were higher.

This fact was surprising since efficient markets should, at least in theory, price stocks based on future cashflows. Not seasonal changes.

Why did the predictably higher sales of ice in the summer, cause the prices of ice companies to trade for more in the summer?

Shouldn’t these companies' stock prices reflect their long-term average annual sales and not just what has happened recently?

However, numerous empirical examples showed that Companies with seasonal businesses have higher prices in the seasons when their earnings are higher.

Why is this?

Availability Bias

Availability Bias suggests humans subconsciously base their decision-making on what is easily available to recall in their minds, which is often not the most probable events but the most recent ones.

This means that what we’ve recently seen and heard in the news and social media tends to have an unjustifiably large influence on our outlooks for the future. As a result of Availability Bias, we think that what we are hearing and seeing now is a permanent trend that is not likely to go away anytime soon.

As it relates to investing, investors tend to unfairly discount that which is probable in the long run and requires them to wait.

Allah swt says in the Holy Quran…

خُلِقَ الْإِنسَانُ مِنْ عَجَلٍ

Humankind is made of haste

Quran

The truth of the matter is, over time, the most probable prediction for prices after a dramatic change is that they revert to their average trends.

Not always, but probably.

The book “Misbehaving” by Richard Thaler refers to a study done where the best-performing stocks on the New York Stock Exchange were labeled “winners” and the worst-performing stocks were labeled “Losers”.

They took a group of the biggest winners and losers (say the most extreme 35 stocks) and compared their performance going forward. Over the next 5 years, the stocks labeled losers outperformed the market by 30% whereas the stocks labeled winners underperformed the market by 10%.

In other words, a difference in performance of 40% was observed between "winners" and "losers" in favor of the "losers"!

As long as the period looked back on to label stocks as winners and losers was long enough, say three years, the “losers” portfolio did better than the “winners” portfolio.

Now I’m not saying go out and buy shares of Blockbuster. Some companies are in industries that are dead or are dying.

What I am saying is that it often pays to be a contrarian.

That is, it pays to not follow the crowd.

When companies in growing industries, and low levels of debt, experience dramatic drops in price because of some news event, going against the crowd can be very profitable.

When people are bullish on energy and bearish on tech, it’s often much more profitable in the long run to be bullish on tech and bearish on energy.

This is why most of my portfolio right now is growth tech stocks.

Requirements for Success

For the contrarian trade to work, you need to invest using money you are not going to need anytime soon.

Don’t invest with borrowed money, that’s always a horrible idea.

You also have to have a stomach for volatility.

If you’re investing in a stock that is down a lot, chances are you haven’t timed the bottom perfectly and it will likely go down even more.

Finally, you have to be patient. There is no telling how long it will take for the market to turn around after a downturn. If you've done your due diligence and your investment thesis still holds, don't panic at the realization of a prolonged downturn. Simply use it as an opportunity to accumulate more.

In summary, the way to trade the news profitably is often to do the exact opposite of what the crowd is doing, invest with money you don't need anytime soon, don't mind the volatility, and be patient.

Leave a Reply