To become wealthy it makes sense to look at what the wealthy do.

If you do this, something that will inevitably stand out to you is that the wealthy don’t just go to work in businesses, they own businesses and let others who work in those businesses build wealth for them.

Fortunately, we live in a time where owning a business has never been easier and you can do so by owning stocks.

In order to own a stock, you have to have an online brokerage account.

A brokerage account for stocks is like a checking account for cash.

You keep your cash in a checking account and your stocks in a brokerage account.

Where Do I Buy My Stocks?

I’ve received many questions asking me what brokers I use to buy stocks so in this article I’m going to review three brokers that I have experience buying stocks with Fidelity, M1 Finance, and Robinhood.

Now let’s talk about how these brokers are different by going through the pros and cons of each broker:

Fidelity

I’ve used Fidelity for the past 10 years so I’m intimately familiar with their service.

Pros

1. Customer Service

I like the fact that I can call them and talk to an actual person.

If you call or attempt to chat with them nowadays, because of the volatility in the markets, the wait time is rather long.

However, once you’re connected, the person you talk to typically very helpful and sticks with you until your question is answered or issue is resolved.

2. Order Execution

What I mean by order execution is the quality of the price you get when you buy and when you sell a position.

Here’s what you should understand when it comes to the price you get when you buy or sell a stock:

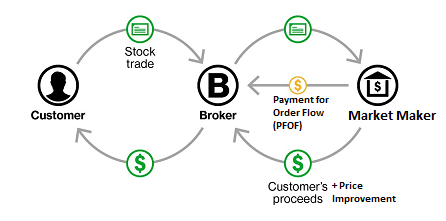

- Not all brokers give you the same price.

- Brokers use the services of market makers when they execute a trade.

- Market Makers attract brokers by offering them Profit from Order Flow and Price Improvement.

- The Profit from Order Flow is what the broker gets as profit from the Market Maker when they route an order to them.

- The price improvement is what the customer benefits from in the form of a price that is higher if they are selling and lower if they are buying.

- The more Profit from Order Flow a broker collects, the less price improvement their customers are going to experience.

- In the case of Fidelity, they collect $0 from order flow.

- This means as a customer, you're likely going to get the best price when you use their service.

Stockbrokers.com rated Fidelity #1 in order execution in 2020.

3. An Established History

Fidelity’s discount brokerage was established in 1978.

They’ve been through recessions, stock market crashes, bubbles and busts and they’re still around.

So they have a well-established track record.

This is what you want to see when you park your money long-term with a particular brokerage.

Cons

1. Automatic Investment of Cash Into Interest-Bearing Assets

Fidelity does this to advantage the customer but as a Muslim trying to avoid paying or receiving interest in any way it means that I have to take out any cash from my brokerage account so it isn’t accruing any interest.

2. User Interface Isn't Intuitive

I’ve seen many reports online that praise fidelity’s user interface.

I’m personally not that big a fan.

Their website is tough to navigate. There are way too many clicks to get to where you want to go and some things that should be obvious aren’t.

Recommendation

M1 Finance

Below is my review of M1 Finance.

Pros

1. Designed for Long-Term Investors: Promotes Good Investing Habits

The reasons why I say this about M1 Finance is because:

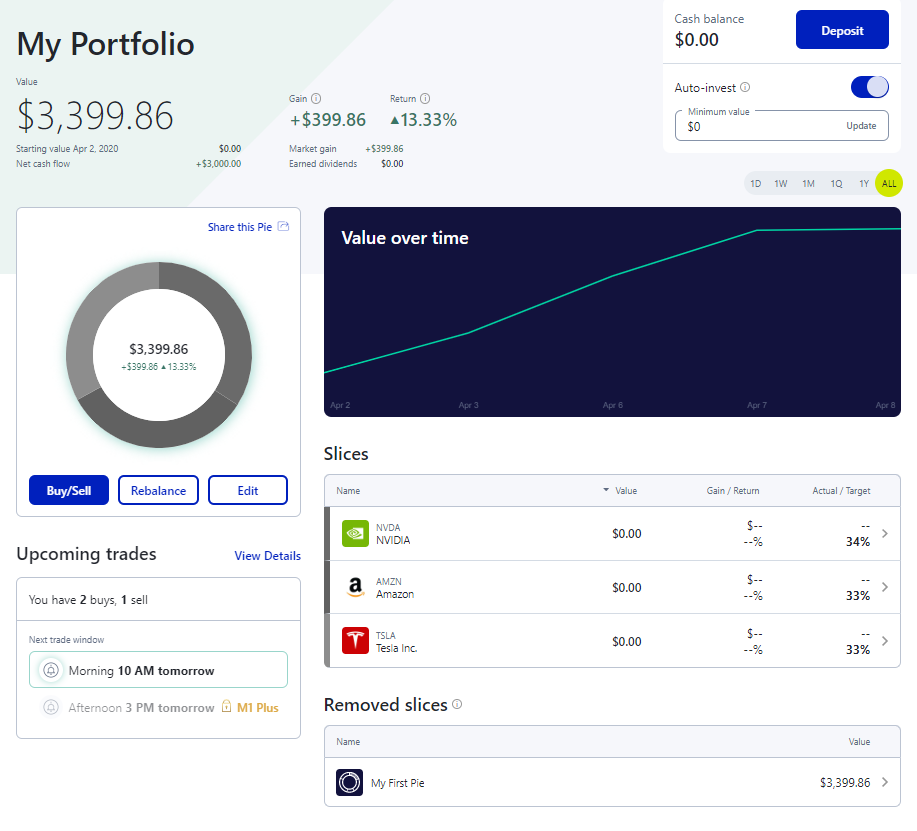

It takes a portfolio approach to investing.

To invest with M1 finance you start by creating a portfolio of stocks with given weights (they call them pies).

Afterwards, every dollar you assign for investment gets invested into your portfolio according to the weightings that you’ve assigned (with automatic rebalancing).

Trade Execution

Trades are placed once per day during a “trading window,” which puts intraday transaction timing out of your control.

This makes it virtually impossible to day trade which forces the investor to focus on the long run.

2. Intuitive User Interface

It took me about a day to become comfortable with their user interface.

Additionally, there are a ton of free YouTube tutorials that walk you through their user interface step-by-step.

Cons

1. Youth

M1 Finance launched in 2016 so it doesn’t have as robust a track record as Fidelity.

2. Support

There is no online chat/phone support.

If you need support, you just submit a request through their support page and they create a ticket for you which they’ll follow up with you on.

3. Minimum Investment Amount of $100

M1 has a $100 minimum account size for taxable accounts and a $500 minimum for retirement accounts.

Once the $100 account minimum has been reached, deposits can be as small as $10.

Recommendation

While I generally despise most new investing apps, M1 Finance is an exception. It is clearly designed for long-term investing and simply can’t be used for active trading.

I think it’s a great option for people who are looking to get started with investing, make regular contributions to an investment account and don’t want to fall into the temptation of overtrading and trying to time the market.

I personally use M1 finance and Fidelity for my investment accounts. I have my retirement account with Fidelity which has the bulk of my savings and I have a smaller amount in M1 finance.

I like keeping the majority of my money with more established brokerages.

I would also not advise putting all your money with any one brokerage.

Instead, try to have your money spread out amongst multiple brokerages in case some glitch happens with any one brokerage not all your money is tied up with them.

Robinhood

Robinhood gained a lot of traction after it launched in 2013 because of its pioneering of commission-free trades.

There was a point in time where Robinhood was the only broker offering commission-free trades. Now, free-commission trades have almost become an industry standard.

Pros

*Cue Cricket Sounds*

Cons

1. Designed to Constantly Nudge You To Trade

From the bursts of confetti you get when you make a trade, to the dramatic look of numbers and charts when a stock price is rising or falling to the list of popular stocks to trade, and the news feeds on the main page and individual stock pages, everything about Robinhood seems designed to motivate impulse trading.

When you mix this design with the ability to execute a trade in seconds the combination can be toxic for people's wealth.

One may ask: why does Robinhood want you to actively trade on their platform if they aren’t collecting any commissions from trades?

Remember what we said about brokers having to balance between the price improvement they pass on to their customers and the Profit from Order Flow they collect from Market Makers?

Bloomberg News reported in October 2018 that Robinhood receives almost half of its revenue from Payment for Order Flow.

The Wall Street Journal found that Robinhood "appears to be taking more cash for orders than rivals," by up to a 60-to-1 ratio, according to its regulatory filings.

If half of Robinhood's revenue is coming from Payment for Order Flow, this means they have ample motivation to try to increase order flow as much as possible.

How do you do this? you design an app like Robinhood that makes trading feel like playing a game of Candy Crush.

2. Implementation Record

Security Breach

In July 2019, Robinhood admitted to storing customer passwords in cleartext and in readable form across their internal systems, according to emails it sent to affected customers. Robinhood declined to say how many customers were affected by the error and claims that it did not find any evidence of abuse.

Outage

On March 2 2020, Robinhood suffered a systemwide, all-day outage during the largest daily point gain in the Dow Jones' history.

In addition to a slew of other implementation hiccups Robinhood has had in recent history.

Recommendation

To be very blunt, I don’t think Robinhood's service was designed with the best interests of investors at heart.

It gets users into habits which I think are detrimental to their long-term investment performance.

Not to mention it's dismal implementation record.

Accordingly, my recommendation is to stay away from Robinhood.

It’s not for serious minded investors who are looking to build long-term wealth.

Assalam alaikum,

I am planning to open an account with Fidelity. But I see automatic cash allocation to interest bearing accounts. How to avoid this?

Assalam alaikum,

After going over this review, I don't know how Fidelity becomes a solid choice to use. If they have interest bearing accounts then why to deal with that kind of brokerage. Have you not looked into E*TRADE or Ameritrade or Webull? Don't think they have any interest bearing accounts to deal with. Just because you using Fidelity and M1 Finance doesn't mean you don't compare other brokerage companies. Would be nice if you have done extensive comparison across other companies. I don't use Robinhood anyway after hearing so much negative about them but several if found using Webull.