To answer the question, "are options halal or haram?" let's make sure we understand some key definitions:

Generally speaking, there are two types of options:

Call Options

These are financial contracts that give holders the right, but not the obligation, to buy an asset at a certain price.

For example, Johnson & Johnson shares (JNJ) trade for $100/share.

A call option may give its holder the right to buy JNJ for $110/share for the next month.

This means the option will only hold intrinsic value if the price of JNJ rises above $110/share within the next month. Otherwise, the option expires with no value.

Why Use a Call Option?

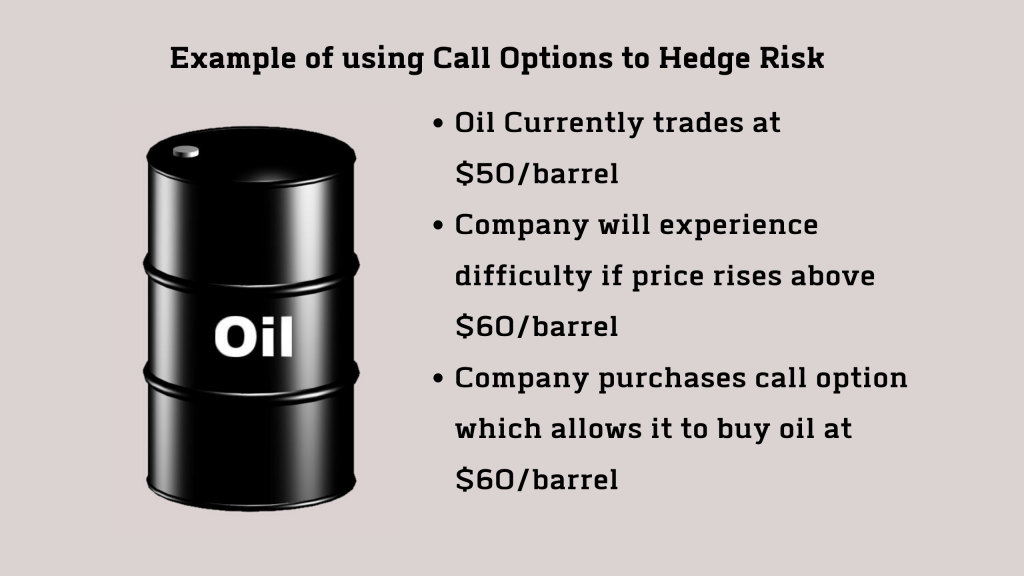

Hedging Risk

If you need to buy a particular asset in the future and you want to hedge the risk of the price going up during your buying window, a call option can limit this risk for you.

For example, you represent a multinational corporation and are concerned that the price of oil rising above $60 per barrel within the next year will be detrimental to your company.

To hedge this risk, you can purchase a call option that allows you to buy oil for $60 per barrel at any time in the coming year. This will protect you in case oil prices rise above your $60 threshold during this period.

Speculating on Price

Call options can be used to speculate on the price of the underlying asset.

For example, if you believe that the price of oil will rise above $60 per barrel in the coming year, purchasing a call option that allows you to buy oil for $60 per barrel at any time in that period could be a profitable decision.

If the price of oil does indeed rise above $60, the option will gain intrinsic value, with its worth increasing as the price of oil goes up.

However, if the price of oil reaches $70 per barrel, your right to buy at $60 per barrel will have an intrinsic value of $10.

Put Options

These are financial contracts that give the holder the right, but not the obligation, to sell an asset at a certain price.

Why Use a Put Option?

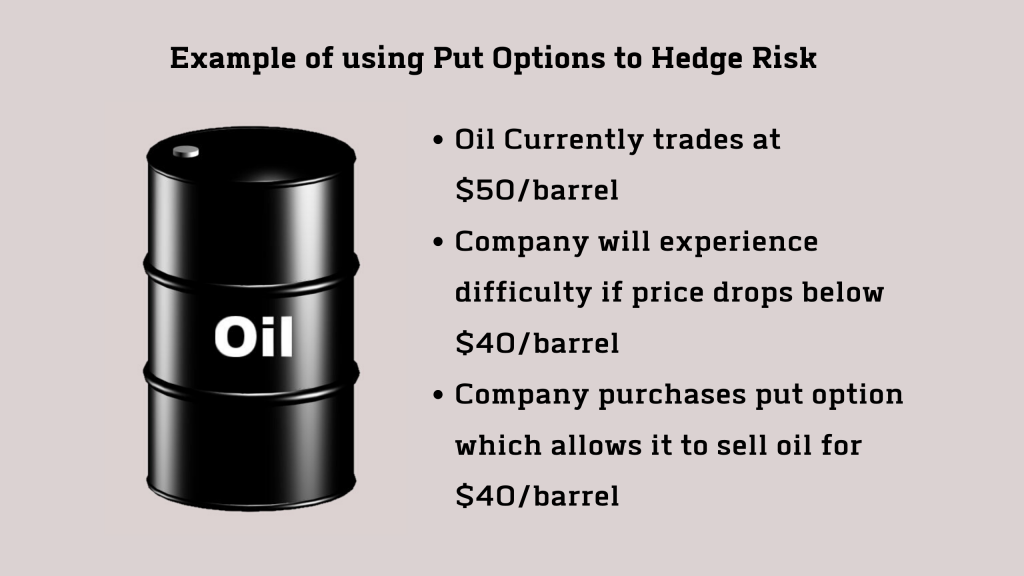

Hedging Risk

If you own a particular asset that you intend on selling and you want to hedge the risk of your asset's price going down, a put option will allow you to do this.

For example, you represent an oil corporation and are aware that selling 1 million barrels of oil for less than $40/barrel within the next year could cause problems for your company.

To mitigate this risk, you can purchase a put option that allows you to sell your oil for $40 per barrel even if the market price drops below that level. This will protect you from the negative consequences of oil prices falling below your $40/barrel threshold.

Speculating on Price

Put options can be used to speculate on the price of the underlying asset.

For example, if you believe that the price of oil will drop below $40 per barrel in the coming year, purchasing a put option that allows you to sell oil for $40 per barrel at any time in that period could be a profitable decision.

If the price of oil does indeed fall below $40, the option will gain intrinsic value, with its worth increasing as the price of oil goes down.

However, if the price of oil falls to $30 per barrel, your right to sell at $40 per barrel will have an intrinsic value of $10.

Is Options Trading a Form of Al-Maisir (Gambling)?

In the generous Quran 5:90-91, a translation of what Allah (SWT) says is:

O you who believe, indeed, intoxicants, Al-Maisir, [sacrificing on] stone altars, and divining arrows are but defilement from the work of Satan, so avoid them so that you may prosper. Satan wants to cause enmity and hatred between you through intoxicants and Al-Maisir and to avert you from the remembrance of Allah and from prayer so will you abstain from these things?

The Holy Quran 5:90-91

Al-Maisir is present in zero-sum games involving money.

These zero-sum games:

- Don't produce anything useful (a good or service).

- Create enmity and hatred between participants since one party's gain is necessarily the other party's loss.

A prime example of Al-Maisir is gambling in a casino.

When players gamble, they are risking their money in a zero-sum game wherein nothing useful is created while animosity and hatred is sown between the competing sides of the gamble.

As it relates to options and their similarity with gambling...

Are Options Useful?

They can be.

When options are used to transfer a specific risk to a more willing and able party, this is useful.

Suppose you are carrying a heavy backpack, and it is causing you strain.

A person with a strong back offers to carry your heavy backpack for a fee.

Is this person's service useful to you? certainly.

You relieve yourself of the heavy backpack, and the strong-backed person is able to earn money by carrying it for you.

The heavy backpack in our analogy represents risk and the options contract serves as the mechanism for transferring the risk from one party to another party who is more willing and able to bear it.

This is how options can be useful.

Are Options Always Useful?

No.

When neither side actually owns the asset, there is no risk transfer and therefore no usefulness.

There is no heavy backpack changing shoulders.

The backpack doesn't even exist before the option contract is written.

In this case, the option contract is merely a financial bet between two parties devoid of practical usefulness.

Additionally, since one party's gain is the other party's loss, enmity is sown between the opposing sides of the contract.

Therefore I assess the case of options trading wherein neither buyer or seller actually owns the underlying asset to be a form of prohibited al-maisir.

I would venture to guess that the vast majority of options contracts available to retail investors fall in this category.

How Is Options Trading Different From Stock Trading?

Stocks represent ownership in a company and have intrinsic value. When you purchase a stock, you assume the risk of ownership from the previous owner.

There is no new risk being created when stocks are traded, only risk transfers.

On the other hand, options derive their value from their underlying asset. Hence their classification as Derivatives.

An options contract written without an underlying asset creates new risk, this risk is essentially "created out of thin air."

This is why Warren Buffett referred to derivatives as "financial weapons of mass destruction."

Consider the following example...

Let’s say you want to speculate on the price of XYZ company by owning its stock.

If XYZ has 10 shares outstanding, the maximum number of XYZ shares anyone can buy is 10.

However, with options, you can potentially buy an unlimited number of contracts on those same 10 shares.

This means there is the potential for unlimited risk creation using options. This is why it is necessary to have additional restrictions in place to manage this risk creation.

Conclusion: When Does Options Trading Become Al-Maisir?

In short I assess options to be indistinguishable from prohibited Al-Maisir when they create risk and halal when they are used to transfer risk.

Now let's apply this understanding to some of the most common option trades:

Buying Calls

When a call option is bought, the buyer of the option obtains the right, but not the obligation, to buy a certain quantity of the underlying asset at a predetermined price (the strike price) at any time on or before the expiration date of the option.

Is Risk Created?

If the seller holds the underlying asset, the price risk is transferred from the seller to the buyer in the amount of the price of the sold call.

E.g. Adam owns a $100 share of Tesla. Therefore Adam is at risk of losing $100 by continuing to hold Tesla. If Adam Sells a call option on his share for $5, then the maximum Adam can lose from holding the Tesla share is $95 ($100-$5). Therefore by selling a Call, Adam partially transferred the risk of ownership to the Call Option buyer.

If the seller doesn't hold the asset, then no risk is transferred, only created.

Halal or Haram?

If the seller holds the underlying asset, Halal.

If the seller doesn't hold the underlying asset, Haram.

Buying Puts

When a put option is bought, the buyer of the option obtains the right, but not the obligation, to sell a certain quantity of the underlying asset at a predetermined price (the strike price) at any time on or before the expiration date of the option.

Is Risk Created?

If the buyer owns the Put's underlying asset, risk is transferred from the option buyer to the seller.

If the buyer doesn't own the asset, then no risk is transferred, only created.

Halal or Haram?

If the buyer owns the Put's underlying asset, halal.

If the buyer doesn't own the Put's underlying asset, haram.

Selling Naked Calls

Selling a Naked Call happens when the investor sells a call option without owning the underlying asset.

The seller of a Naked Call option has unlimited potential loss since there is no limit on how high the price of an asset can reach.

Is Risk Created?

Naked calls don't have associated assets, therefore, new risk is created everytime a Naked Call option is written.

Halal or Haram?

Haram.

Selling Naked Puts

Selling a Naked Put happens when the investor writes, or sells, put options without holding a short position in the underlying security.

Is Risk Created?

If the buyer holds the underlying asset, the price risk is transferred from the buyer to the seller.

If the buyer doesn't hold the asset, then no risk is transferred, only created.

Halal or Haram?

If the buyer holds the underlying asset then it's halal.

If the buyer doesn't hold the underlying asset then it's haram.

Selling Covered Calls?

A covered call is an options strategy in which an investor holds a long position in an asset and sells call options on that same asset in order to generate income from the options premiums. This strategy is considered "covered" because the investor already owns the underlying asset, so they have the underlying stock to sell if the call options are exercised.

Is Risk Created?

No. The options are associated with actual assets. The option seller has partially transferred the price risk of their shares to the buyer in the amount of the price of the sold call.

E.g. Adam owns a $100 share of Tesla. Therefore Adam is at risk of losing $100 by continuing to hold Tesla. If Adam Sells a call option on his share for $5, then the maximum Adam can lose from holding the Tesla share is $95 ($100-$5). Therefore by selling a Call, Adam partially transferred the price risk of his shares to the Call Option buyer.

Halal or Haram?

Halal.

Selling Cash-Covered Puts

A cash-covered put is an options strategy in which an investor sells a put option while simultaneously setting aside the capital needed to purchase the underlying stock at the option's strike price.

Is Risk Created?

When the buyer owns the Put's underlying asset, risk is transferred from the option buyer to the seller.

When the buyer doesn't own the Put's underlying asset, no existing risk is transferred, only new risk is created.

Halal or Haram?

When the buyer owns the Put's underlying asset, halal.

When the buyer doesn't own the Put's underlying asset, haram.

A Summary of Is Trading Options Halal or Haram?

| Option Strategy | Is Risk Created or Transferred? | Verdict (My assessment only) |

|---|---|---|

| Buying Calls | Transferred if the seller owns the underlying asset. Created if the seller doesn't own the underlying asset. | Halal when seller owns underlying asset Haram when seller doesn't own underlying asset. |

| Buying Puts | Transferred if the buyer owns the underlying asset. Created if buyer doesn't own underlying asset. | Halal when buyer owns underlying asset Haram when buyer doesn't own underlying asset. |

| Selling Naked Calls | Created | Haram |

| Selling Naked Puts | Transferred if the buyer owns the underlying asset. Created if buyer doesn't own underlying asset. | Halal when buyer owns underlying asset Haram when buyer doesn't own underlying asset. |

| Selling Covered Calls | Transferred | Halal |

| Selling Cash-Covered Puts | Transferred if the buyer owns the underlying asset. Created if buyer doesn't own underlying asset. | Halal when buyer owns underlying asset Haram when buyer doesn't own underlying asset. |

When you are trading options on stocks, for example, you have no visibility into whether or not the option is associated with an asset or not.

So then the only case when it becomes permissible to deal with options is if you own the asset.

So either your own the asset and you’re buying a Put (or a right to sell). This is also called a protective put.

Or

You own the asset and you’re selling the right to buy it from you, a call (or a right to buy). This is also called a covered call.

Final Thoughts

For all the scenarios I didn't cover, just ask yourself, is risk being transferred or created? If the options trade is creating risk then it is haram. Transferring risk is halal.

Those were my two cents on options trading anyway and Allah swt knows best.

I wasn't to get involved in investing / trading but in this minefield, I'm confused as to what I should dabble into? Forex? Stocks? Day trading, options, futures AAARRRGGHHH!! If only I had received one simple answer I would just stick to it and not waste my time reading about other markets!! OH ALLAH PLEASE HELP!! I JUST WANT TO BETTER MY FAMILIES LIVES AND I KNOW IF I PUT MY MIND TO IT I'LL DO WELL

Of the things you mentioned, Stocks :)

Sill lost trying to understand at what point it's halal or Haram.

Is collecting premium from a vertical put/call spread halal or haram? I want to use this premium as a means of passive income. in regards to risk- when using a vertical spread the risk is calculated to the dollar and so is the net profit. This seems the safest way to be involved in the market. Is this halal or haram? please shed some light on this specific strategy of option trading.

Curious to see Rakaan’s thoughts on this as well. Including selling covered calls/wheel strategy

I also want to use covered calls for income. I see many posts about options being haram but I am not clear if they understand what options are and have really taken up the challenge of the issue. Here of course the author does but still there are many scenarios to tease out. 1. The idea that this is

Somehow different from stocks is only true on the very fringes of the argument and certainly not true from the intention of the people making the trades 2. We are dealing with stocks which we know are by and large halal (as long as we are not speculating, gambling, putting our wealth and family at risk or trading in haram industries). Simply because a covered call sells someone the right to purchase a stock does not mean we are working only with intangibles- the thing that holds the VALUE is the stock itself. I have the stock NOW- person X does not want the stock now, for many different reasons. but ultimately they are giving me money for the stock itself if they choose to buy it. If I have no stock, there is no premium. On a covered call. 3. One can look at this as genuinely providing a service- and both people can win. I own stock x at $100 my income goal is to make 5% on this stock in one month. I also would like to protect my assets so I am willing to sell another buyer the potential upside. If it goes way up- we both win. If it goes way down we both lose. If it is in the middle, we’ll perhaps I have benefit and the buyer does not. It seems in this logic that the most halal versions are ones in which the option gets exercised, or where the intention is not simply to take the buyers money hoping it expires. So ITM covered calls would seem to be ethical and halal as long as you didn’t have inside information the stock would tanks, but then you would sell the stock rather than the call. out of the money calls close with strike price close to current price with reasonable expectation of hitting strike would be halal to. What could be harm is selling calls way OTM to risk takers - there is little likelihood of service being provided, seems to involve gambling or speculation on one side at least and there will be consistent win-lose zero sum game vibes. The only real underlying question seems to be whether a premium a halal on anything - if you see a car for sale and it’s 10k and you either don’t have the money or want to shot around but really don’t want to miss the opportunity... you give the owner 100$ and ask for the right to buy the car for sale price next weekend. Is that haram or halal? The owner is saying he is willing to turn other buyers away and hold the car for you because you just gave him 100$- you don’t have to buy it but you can if you want to, if it seems right in one week. This doesn’t seem unreasonable. This seems like a service one is providing using their wealth to give other people options and potential opportunity.

Although I understand what you're saying, not sure I agree. There is a transfer of risk on a long call/put which is the cost of purchasing the option...that amount of money is the defined and maximum risk. The gain is not entirely based on 'speculation' like in gambling at the casino. At the casino, it is a 'game' of chance...you hope the dice will land on 7 or the cards will be 21 or the roulette wheel will stop on red. In options, if you are using technical analysis and various indicators (and have invested time and money in educating yourself), then using options is based on some education. News (like a new product launch or M&A) will create change that cannot be incorporated. Regarding 'value', one could strongly argue that if the long call/put or even vertical goes in your favour, then the gains are used for creating value in the person's life - such as buying food, clothing, zakat, housing, etc... That money that is spent on food also helps the grocery store pay wages and also goes to the farmer...the trickle down of the gains creates value for many. So in my opinion, trading options whether long/short positions or verticals is halal.

1-Just because the risk is limited to the purchase price of the option, doesn't mean this risk wasn't created with no corresponding value to justify this creation.

2-As for whether options are a game of chance or not, this is completely irrelevant to the question of whether or not it is gambling. Poker is a game that involves alot of skill. In fact you could argue that poker is entirely a matter of skill since everyone pretty much receives the same cards in the course of 1000 hands. However, because poker involves putting your money at risk with no corresponding value creation it is gambling.

3-You could make the same argument for any type of haram income earning activity. For example, I play poker to make money and I use that money to feed my family therefore I am creating value through my playing of poker. No. Feeding your family is halal. Earning money through poker is not. Regardless of what you do with the proceeds. And Allah knows best.

Thanks for the reply...but;

1 - if we follow this argument, then nothing is created without risk with no corresponding value. A company could make a sofa at a cost of $100 and sell it for $150. Their risk is $100. But if the sofa does not sell at $150, they reduce the price to $100 - the break-even. Even then, say it doesn't sell, they keep reducing the price to, say $75 or $25 and the sofa company is now in a loss position and no value has been created. Switch the word 'sofa' for 'option' and it's the same way an option trades.

2- poker and options are different. You need 1000 hands for everyone to have the same cards before 'skill' is involved. With options, everyone has the same 'cards' immediately and there is no waiting for 1000 hands for everyone to be made equal. If anything, one could argue that everyone is dealt the same cards in options and it is your skill whether to buy/sell an option. Your skill determines whether to 'play' the option.

3- an accepted definition of 'value creation' would be good. For some, putting food on the table is value creation and agree that this is halal. But to buy the food, then cook it with gas/electricity one needs money. So being able to buy/sell an option and exit profitably is value creation. Otherwise, the many Muslims that work for non-Islamic banks or financial institutions or software companies or media companies or food companies or are earning haram money.

The value being created using options is defined. So maybe long calls/puts are not halal because there is unlimited gain even though the risk is clearly defined. But spreads have a defined risk and a defined profit at the time of entering the trade.

Short puts are haram because 1) not owning the underlying asset....just borrowing it and 2) undefined risk and 3) there's an interest cost of using margin.

that means option is halal ?

You forgot to mention that the seller of the call or put...that is the one who was given the bag of rock to carry on his back, can simply decide not to carry it anymore by closing his option. That is He Buy to Close his contract.

Please try to understand the options contract dealing from beginning to end before writing.

Try to understand fully what is Sell to Open, Buy to Close. Buy to Open, Sell to Close. About Rolling the contracts.

This are all choices of an option contract that can be exercised anytime by buyer or seller.

Like I said, I can choose not to carry your rocks on my back by buying back my contract as and when I so wishes.

The option contract can only proceed when both the seller and buyer agreed to proceed, if not, either seller or buyer can terminate and close their option contract anyrime they so wishes. HALF BAKED KNOWLEDGE is dangerous and unwelcomed.

Unfortunately it is difficult to understand the complete argument of your comment.

One the one hand you say "The option contract can only proceed when both the seller and buyer agreed to proceed" and then say "IF NOT" "either seller or buyer can terminate and close their option contract anyrime they so wishes". The "IF NOT" is crucial because it implies that the buyer and seller may not agree and therefore the contract cannot proceed.

This is incorrect.

The seller (or buyer) of an option can close their position but only if there is a willing participant on the other side of the trade - a willing buyer (or seller). So these 2 parties MUST agree on a price and when they do, the contract is closed. So there is ALWAYS an agreement between buyer and seller in an option contract at any point in time.

Whether opening a trade or closing a trade - there MUST be an agreement between buyer and seller.

You need to be clearer whether you are discussing long option positions or spreads or short option positions or something else.

As you correctly state, half-baked knowledge is dangerous and unwelcome. Perhaps you should consider further educating yourself? We are here to help.

Have you ever trade options before ? Eg : Before you sell or buy an option, you checked on the open interest first. Do you know what open interest is ? Let’s assume you knew. So I will proceed.

You SELL TO OPEN an option from your laptop, let’s say on TESLA through your broker then it will be send to the OCC ( do you know what OCC is ? Have you traded options before ? ) who will matched your sell order to a buyer.

The buyer ( no idea who they are ) will be matched to you by the OCC machine.

You collected the premiums.

As and when you decided that you wanted to EXIT THE TRADE, you select BUY TO CLOSE on your laptop... through your broker trading platform....and it will be send to OCC who will matched you with a Seller ( don’t know who he is ..all randomly selected by the OCC machine ) ...

Within seconds your contract WILL BE CLOSED.

Are you sure you have traded options before ? Your questions sounds like you need help in understanding options trading principles and technologies. Just a tip...it is A MACHINE that matched buyer and seller, it is why OPEN INTEREST is important.

I don’t need your help in anyway though, thank you very much. It is best that you advised yourself to bake yourself.

Ali, your comments are petty and immature. Let's bring the conversation to an adult-level.

Your initial comment stated "...can simply decide not to carry it anymore by closing his option".

If you have a long position and there is no open interest....and you decide to close the contract, you CANNOT because there is no one on the other side of the trade. So the OCC can send the order, but it will not fill because there is no one on the other side to complete the trade.

Even if there is just a handful of Open Interest, the bid/ask spread will likely be so wide that you'll close at such a loss if you put a LMT order in. If you put a MKT order...well, then you don't know what you're doing and should not be trading options.

Not sure whether you just paper-trade or are talking theory....try it in real life. Enter a position where there is little to no Open Interest and then try to close the trade.

Then come back and share your experience.

In the meantime, have a wonderful day!

I have few things regarding Options trading. If I am wrong then please correct me.

1) Whether Stock or Option they are not speculative or you can say it depends on the trader if he/she is not able to understand the Technicalities behind trading then it becomes speculative for him/her. But for those who understand fundamentals and technical things they are predicting future price value.

2) Let me clear this.. "Underlying asset is not owned by you so its haraam to sell call/put to others

Hadith that is generally referred to is that if you do NOT own that thing you have no right to sell it. Here I should say that TODAY's financial system is different and this hadith cannot or should not be applied to today's markets. This hadith, for my understanding, was/is for those cheaters/thieves in those days who use to sell sheeps and camels to others even though they did not own them. But here this Financial system is different and whole world know underlying asset may not be yours.

3) It is not win-win scenario. One has to definitely lose money at the end.

While this scenario is true when it comes to gambling in casino, it is not true here in Options. People may be writing call/put to HEDGE risk and even if Option seller might lose money in call/put but his/her stock value might be increasing. So overall there might be NET profit for Option seller while even buyer might be making profit.

Salaam,

I really like the framework you've put around this discussion by defining Maysir with the twin conditions of creation of risk and non-creation of value. I'm still reading up and considering whether or not this is truly a sufficient definition, but I hope to be swayed.

One outstanding question I have is with regards to the distinction you've drawn between speculating on the price of assets and speculating on the price of an options contract (or other derivatives). The distinction seems artificial for the following reasons:

1/ The argument hinges on the speculation on asset price not creating risk. This is untrue, surely. Market participants speculating can create a bubble, and that certainly does increase total risk of the participants. If I buy a stock from the previous owner at 2x the price he or she bought it at, with no corresponding increase in the value of the underlying asset, that is risk creation.

2/ The prior issue notwithstanding, your argument also somewhat hinges on the notion that since there are a fixed number of shares outstanding (the float), the total risk is constant. My comment above indicates that the conclusion is incorrect, but I also believe the premise is flawed. Companies can issue more stock "out of thin air". You may then argue that it is the company that engages in the unlawful when they create stock, but it is fine to trade these stocks once they are created, but that is tantamount to saying you can trade options once they've already been written.

In sum, I think the distinction you've created between speculating on stocks and options is a little arbitrary - a stock is a 'derivative', in a sense, just as much as an option is. I think a little more thinking needs to be done to make sense of this, but please point out if I've missed something.

JazakAllah khayr for your insights!

Salam

Are stocks rights and warrants considered the same as options?

I think everyone is missing the point, speculating on option pricing is irrelevant because no one on this blog is an actual derivatives trader and has a sophisticated model enough to see where implied volatility is cheap or not and trade. The majority of people here are using options to hedge their stock positions.

I highly doubt anyone is selling/underwriting outright options considering the substantial risk that comes with it and the fact doing so without a hedge in place is the definition of risking unlimited wealth for small material gain, that in itself is gambling.

If you are trading butterflies or straddles/strangles which set the amount you can lose (by the max of all the premiums you paid) then this seems okay.

In any case to be able to trade options you’d actually need a meaningful amount of money in your broker account (100k ) and enough margin.

Trading CFDs or binary options is without a doubt haram as you do not own any part of the asset.

I think you need to break it down into are you owning something or not, as options are physically deliverable you do own the right to buy/sell the stock at a specified date and price or to sell it. So by that logic it’s allowed.

As convoluted as this all sounds, if you do not understand something don’t trade it. And please guys do not trade levered products without understanding the risks involved, there is a reason why 80% of retail traders lose money trading with CFD brokers. Instead invest a portion of money in halal ways with a diverse range of stocks with the intention that if you lose half of your portfolio you will still be fine because key point here you still have a income from a normal day job.

The best traders are not those that are super levered with a get rich quick mentality but are making small gains on a daily basis using intellect and understanding the products they trade and the news that affects them.

At the end of the day Allah knows best, happy to field any questions from you guys, I’m not a sheikh by any means but I am an actual investment banker that worked at the top American/European Investment banks (not in ops but actually front office) and have become increasingly more diligent in what is deemed as halal and haram in financial markets.

Here is my question and would really appreciate your response.

If I do not want to own a stock that I really like, using the option trade of selling cash covered Put to collect the premium for that stock is halal in your opinion? Say, if I really want to buy a stock at a lower price that I'm comfortable with and have enough money to take the advantage of using the option trade strategy, cash covered Put and eventually close out of the position after the expiration date and collect the premium. This way I thought if the stock price drastically goes up, I can collect extra income and still have a chance to buy my favorite stock at a lower cost if the stock price went drastically down. Please let me know your honest thoughts/opinion before I start doing something which may not inline with the teaching of Quran/Sunnah. Thank you and Jazak Allah khiran!

I mean if I do want to own a stock that I really like, using the option trade of selling cash covered Put to collect the premium for that stock is halal in your opinion?

Correct me if I’m wrong. But a call option is me entering into a contract to purchase a stock at a certain price that I like. The premium that you make from the stock is similar to buying 100 shares at the price of the contract and selling it at the higher price (exercise). Ex: amc is currently at $10. I buy a call option for $15 dollars. The stock jumps to $20. Now I can exercise my contract and buy 100 shares of AMC for $1500 and sell it at at $2000 for a $500 profit OR I can just chose NOT to exercise my contract, and just close it out and collect my profit. Which btw should be $500. By closing the contract and not exercising it, ur just taking a short cut. In the end, the outcome is still the same. It’s the same as me actually buying 100 shares of AMC at $15 and selling it at $20. Yes, I understand that the gains are considered infinite. But all it is, is the buying at selling of 100 stocks. Shortcut. Allah knows best.

Thank you very much for this beautiful article. I read it & learn about many things. I appreciate your thoughts 7 ideas. Well done.

Thanks for sharing the valuble information, this will be very much helpful

Assalamu alaikum wrbh,

Selling Cash covered Puts with the intention of accumulating good shariah compliant business for long term holding, is it allowed in Islam or not ? I mean no speculation on price moves or gambling on the charts but completely reliance on the fundamentals of business underlying and economy.

Is second contract investment trading in crypto through a market analyst halal?

Is it the same as trading in options?

What is buy up and buy down in crypto?

Assalaamu alaikum brother Rakaan,

Thank you for your explanation of what option trading is. From what I understand from your post is that option trading becomes halal if and only if you have the underlying stocks and if you're hedging the risk.

Does "hedging the risk" need to be a factor in order to be halal?

For example: I invested in this company because I believe it will have a bull run. In addition, I'd like to enjoy the premium by doing call options. I am not exactly hedging the risk here, I am using technical analysis to believe that it will go up, so I am speculating (hence why I invested) and I'd like to make some more money using option trading with the underlying stock.

Let me know.

Thanks

You’ve used the word “speculating” which is haram. Whether you use technical analysis or price action or indicators, what we know is that only price determines an entry and an exit. If price moves above a value, you enter the trade. If it falls below a value, you exit the trade. If you enter to “speculate” then you are gambling and you should go to Las Vegas. There is a subtle difference between entering on price action versus entering on technical analysis because with the latter you are predicting a price move based on past movement.

Wonderful thought son the subject- I have a comment or two I hope you will address. First, it seems to me that the type of option should be broken down as well in terms of deciding whether it is speculation, not only the litmus test you provide at the end. For instance- selling a covered call. You know both your upside risk and your downside risk. It is as concrete as it is when buying a stock. Also, purchasing a call- you also know the finite risk of losing x dollars, regardless of whether the contract is exercised or not. Once you write or purchase the covered call the options are not infinite and cease to change. I look at this simply as owning an asset and providing a service to someone else - allowing them to lessen their risk (not put out the capital or hold the asset) which they may want to do for any number of reasons. In this sense, isn’t a buy-write covered call with a clear income intention with known risks neither gambling nor speculation and provides a service.

The arguments I have see on zero-sum game for options are also not strong. There are multiple ways that both people can lose and given both people are assessing their own needs with the writing and purchase of the call, both people can also win, if they are taking responsibility for their decision. My decision to sell a call option at the money and pick up a known premium does not make me a loser if the stock goes up. I still win.

I am just having a really difficult time seeing this as haram- internally the decision to do a buy-write call option actually feels a lot LESS like gambling or speculation than buying stocks for gain in themselves and one is actually providing a service. And as I said, regardless of how we shape the semantics, buying and selling Gold or stocks can also involve speculation and the truth of the matter is, people trading these are relating to them pretty much the exact way options traders relate to options and not as actual assets. Just because it’s good doesn’t make a trade halal I guess and I would hope for an opinion that just because it is an option does not make it haram.

Sorry for the long message, hope you give some thoughts!

Salam

Salamualaykum. Thank you for sharing your thoughts on the matter of options, Rakaan. My question is, would buying LEAP options for TSLA be halal if I am buying for the main purpose of owning TSLA at a cheaper price? I would definitely want to own more TSLA for the long term (to build generational wealth) but I don't have a lot of money to buy at current prices. Would that make the intention of buying LEAPs for this stock halal? Appreciate your insights as always.

Are there any type of options which are halal in natue? In case you reply, please explain it in layman terms. I am noob when it comes to investing.

This Is Halal (Or) Haram: Options

Stock options: Stock options are options on individual stocks. A stock option contract gives the holder the right to buy or sell the underlying shares at the specified price. They have an American style settlement.

Call option: A call option gives the holder the right but not the obligation to buy an asset by a certain date for a certain price.

Put option: A put option gives the holder the right but not the obligation to sell an asset by a certain date for a certain price.

please tell me