Riba is unique in the strength of the verbiage used in the Quran to prohibit it.

The translation of what Allah SWT says in the Quran, Surah Al-Baqarah, about riba is:

278: O you who believe, fear Allah and give up what remains [due to you] of riba, if you are in truth believers.

279: And if you do not, then be warned of war [against you] from Allah and His Messenger. But if you repent, you may have your principal – [thus] you do no wrong, nor are you wronged.

It seems then rather important for us to be able to identify riba. In this article, I hope to enable you to do exactly this. After defining riba, I'm going to share three simple methods you can choose from that should help you when trying to identify Riba.

Defining Riba

There are many different definitions and understandings of riba. Based on my research, the definition I'm most convinced with, that has support in the Quran and Sunnah and enjoys the widest amount of agreement in Muslim scholarship is the following:

Any loan of money which includes a contractual promise of benefit for the lender involves Riba.

There are a number of terms in this definition that merit further examination:

"Loan"

Riba relates to transactions involving loans.

A loan is an arrangement where the lender requires, at minimum, the principal to return to them.

If the transaction doesn't require, at minimum, the principal amount to return to the financier then there is no loan and there is no riba.

For example, assume you purchase part of a business in exchange for a share of its profits. It is entirely possible, in fact, this is the goal, for you to receive more money from this investment than the principal amount that you invested.

Since your principal was at risk when you made this investment, meaning you had no right to receive it back, your investment is not considered a loan, and whatever profit you earn is not considered riba.

On the other hand, if you had made this investment with the condition that at least your principal must return to you, then this is a loan and any profit you receive is riba.

"Money"

It's important to point out that riba applies strictly to lending money.

It is perfectly permissible in Islam to lend the use of other non-perishable assets and charge rent.

"Contractual"

One may argue that even with lending, the lender is risking their principle since the borrower may default on their obligations.

This is certainly true.

However, what matters in identifying riba is that contractually the lender has a right to more than their principal and in case they don't receive their principal back the borrower is in default as per the loan contract.

This is important because when the borrower is deemed in default, the lenders have a whole host of remedies they can resort to that will potentially further increase the financial hardship on the defaulted borrower even if it means not recovering the entire principle for the lender.

"Promise"

A promise means that something is required and expected.

If the benefit is neither required nor expected then it's not riba.

For example, if as a result of a loan to a business owner, a lender receives better service at the borrower's business, and this was completely not required nor expected from the borrower then this is not riba.

"Benefit"

The benefit here is to be understood in its broadest sense and not limited to money.

Going back to our example of the better treatment at the borrower's business, if the loan entitled the lender to receive this better treatment then it becomes riba.

Even though this benefit isn't in the form of money.

It's also noteworthy to mention that the benefit can be fixed or variable. So for instance, if the loan entitled the lender to share in any profits a business earns then this is riba. Even though these profits may range from 0 to infinity. In other words, they are variable, not fixed.

So long as the financier is contractually entitled to their principle back, this is a loan and as a consequence, the lender cannot be entitled to any amount of benefit from their loan without violating the prohibition on riba.

Now for my three methods for detecting riba in any financing arrangement.

Method #1: Is It Charity?

There's a very simple question that you can answer that will tell you if a loan of money involves riba or not. This question is the following:

Is the lender lending their money as an act of charity?

If the answer is no, then it involves riba.

Put differently, lending in Islam can only be done legally as an act of charity.

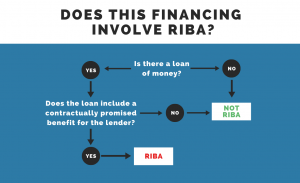

Method #2: How Do You Like Algorithms?

If a financier provides money

And the financier is compensated with a promise of benefit

THEN the financing involves Riba.

Method #3: Decision Tree

If you understand this article, congratulations, you are in a good position to identify if something is a form of interest-bearing debt (Riba) which Islam prohibits.

AsSalaamuAlikum brother,

First of all thank you for having great explanations. Looked at BFF, as per basic principle stated if an investor has a contractual agreement to return principal and anything more, it is riba. Even though BFF is more fair, has a different terminology for payment (% of income) and you get a grace period of 2 years if no job, isn't riba since the the investor is still getting principal and more over the period of time?