So you want to get your money to start working for you by investing in stocks but you're not sure how to get started.

This article will introduce you to 5 important ratios to consider before making any investment decisions.

How to Identify Undervalued Stocks

1. Price/Earnings (P/E)

Price/Earnings (P/E) = Current market price / Earnings over the last twelve months.

This ratio tells you how many dollars you’re paying for each dollar in earnings the company earned over the previous 12 months.

Generally speaking, the higher the PE ratio, the more expensive the company. The lower the PE, the cheaper the company.

Be aware of the drawbacks of this ratio:

The major drawback of this ratio is that it doesn’t account for any reinvestment of earnings the company may be doing nor what the growth prospects for the company are.

Often, as a company is getting started it won’t have any earnings at all or may have negative earnings. This doesn’t mean it’s not a good buy because the growth prospects for the company may be high.

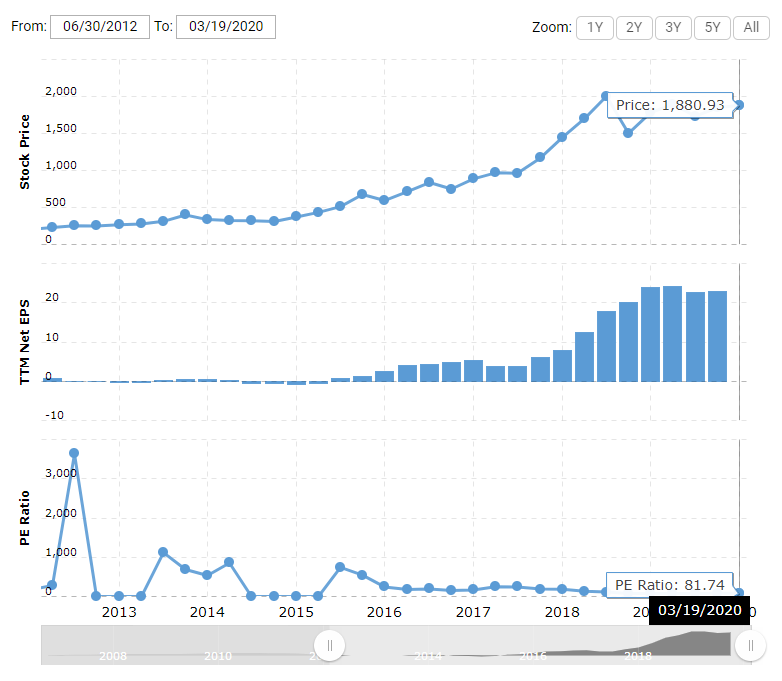

Amazon is a good example of this.

For the longest time, Amazon had almost negligible earnings compared to its sales because it reinvested almost everything it earned back into the business. Only recently has Amazon started to consistently post positive earnings per share.

Amazon’s high reinvestment rate and therefore artificially low earnings meant that it’s PE had been a poor indicator of its prospects as an investment.

A slightly better multiple is to use the forward PE, which divides the current price per share by the expected earnings per share over the next 12 months.

Still, it is very likely that investments a company makes with its earnings will not bear fruit until 2, 3 and sometimes 5 years in the future. So even a forward PE will likely not capture the future growth prospects of a company.

From this we can conclude that while P/E ratios are useful for comparing non-growth companies, they are often poor judges of growth companies (companies that are expected to grow faster than the overall economy).

To compare growth companies with one another, you may want to consider using our next ratio:

2. Price/Earnings/Growth (PEG)

PEG = P/E / Annual Earnings Growth Rate

It’s really up to you to decide what you use for the annual earnings growth rate.

Is it the annual growth rate the company achieved over the last 5 years for example or the annual growth rate you expect the company to achieve over the next 3 years?

Yahoo! Finance uses 5-year expected growth rate and a P/E based on the EPS estimate for the current fiscal year for calculating PEG

So if a company has a PE of 30 and its annual growth rate is estimated at 30% then the PEG is 30/30 = 1.

The lower the PEG the cheaper the stock is.

The higher the PEG the more expensive the stock is.

The drawback of PEG is that it doesn’t give you any information about growth and P/E separately. So if you observe a small PEG ratio does that mean its P/E is low or it’s Growth is high? Similarly, for a high PEG ratio, does this mean the PE is high or that Growth is low?

If I told you that GM had a PEG ratio of .5, does this mean that it is expected to experience rapid growth? Not at all, it just has a really low PE ratio. As of today, 3/20/2020, its PE ratio is sitting at ~3.5!

The next multiple to look at is:

3. Return on Equity (ROE)

Return on Equity (ROE) = Net Income / Shareholders' Equity

ROE tells us how much income the company is able to generate from each dollar in common equity. So an ROE of 1 means that for every $1 dollar of stock investors own, the company is able to generate $1 dollar in net income.

ROE can be a good metric by which company management is judged since it gives us an idea of what management is able to do with every dollar that is given to it.

However, use ROE with caution...

Apple’s ROE for the three months ending December 31, 2019 was 60.19%.

Amazon's ROE for the same time period was 21.07%.

Does this mean that Apple’s management is 3 times as efficient as Amazon’s management?

Not necessarily.

With ROE, you can deflate net income if you’re reinvesting your earnings, as we know Amazon does quite aggressively.

You can also inflate net earnings relative to shareholder equity if you carry a lot of debt on your balance sheet.

Apple may have a 60.19% ROE but it’s not just using shareholder equity to generate returns it also has $116.75 Billion dollars in debt whereas Amazon has $77.54 Billion in debt as of December 2019.

To compare the two debt loads of both companies we will need another multiple...

4. Debt-to-Equity (D/E)

Debt-to-Equity (D/E) = Total Liabilities / Shareholder Equity

Debt-to-Equity is a good multiple for gauging how much a company relies on debt in its operations.

Higher debt to equity multiples tend to indicate higher risk for investors. This is because debt creates fixed liabilities that the business has to come up with regardless of their cash flows. If business is down and cash flow is tight, a high debt to equity ratio means the company may have problems making its debt payments.

What is considered elevated or low Debt-to-Equity will differ dramatically based on the industry.

For example, manufacturing companies will typically have higher debt-to-equity ratios than technology companies.

The debt-to-equity ratios of Amazon and Apple as of 3/20/2020 are:

Amazon’s Total Debt/Equity (mrq) is 124.94

Whereas Apple’s Total Debt/Equity (mrq) 130.40

Typically D/E is primarily influenced by long-term debt since these tend to be the larger accounts. Accordingly D/E may be a bad indicator for the solvency of a particular company.

E.g. imagine you have a company with 1 million in short term liabilities (need to be paid in less than 1 year) and 10 million in long term debt. Compare this to another company with 10 million in short term liabilities and 1 million in long term debt. Both companies have shareholder equity of 11 million. Accordingly the D/E ratio for both companies is 10 + 1 / 11 = 1.

Clearly however the second company with 10 million in short term liabilities has a much bigger solvency problem than the first company, all else being equal.

So if a crisis of some sort is happening and you need to evaluate a company’s solvency prospects in the near term, you’ll want to use a different metric that focuses on short term liabilities. One of the most commonly used is the current ratio.

5. Current Ratio

Current Ratio = Current Assets / Current Liabilities

Current assets refer to cash and cash equivalents that can be turned into cash in less than a year.

Current liabilities refer to liabilities that will come due in the next year.

The current ratio measures a company's ability to meet its financial obligations over the next year.

Too low of a current ratio and the company may be at risk of insolvency. Too high a current ratio and the company may not be using its resources efficiently.

The ideal current ratio will depend largely on the industry.

So if you’re looking for a bargain airline to buy on the heels of the Coronavirus crisis, make sure you pick one with a good current ratio. If air travel doesn’t pick up soon you may start seeing some airlines with bad current ratios start to go belly up.

Conclusion

It's important to understand that financial multiples alone are not enough to know whether a company is a good buy. You have to understand the financial ratios in the context of the overall story surrounding the company.

Most importantly, you have to understand the business you're investing in.

Put differently, while financial ratios are necessary to know they are not at all sufficient.

Happy bargain hunting.

Leave a Reply