“Don’t put all your eggs in one basket.”

A commonly repeated piece of advice.

The logic behind this advice is sound.

If all your eggs are in one basket, and something happens to that basket, you have lost all your eggs.

Similarly, if you pour all your invested money into one stock and that stock goes belly up or loses a substantial portion of its value, your returns are going to suffer dramatically and it may be rather difficult to recover from such a loss.

Accordingly, diversification is recommended.

The Costs of Diversification

However, the benefits of diversification only outweigh the costs up to a certain point and then the costs start to outweigh the benefits.

Going back to our analogy, distributing your eggs into two different baskets reduces your risk substantially with little downside.

However, distributing your eggs into 20 different baskets would require an enormous amount of effort to monitor and maintain.

The more baskets you add, the more difficult it becomes to justify the extra overhead of adding a basket with the reduction of risk you gain.

Similarly, it is easy for me to keep track of two different investments.

Keeping track of 10 is a full-time job.

Keeping track of 50 is simply impossible for one person to do.

In addition to monitoring costs, increasing diversification will not only limit your downside but also your upside as well.

If you have 1 stock in your portfolio and it becomes 10 times as valuable, you have achieved a 1,000% return.

This is certainly possible.

However, if you want to achieve a 1,000% return with a portfolio of 10 different investments, you’d have to find 10 investments that are going to achieve an average 1,000% return.

This is at least 10 times as hard to do.

The Tradeoff

The more diversification you have, the harder it is to go broke but also the harder it is for you to beat the market.

The less diversification you have, the easier it is for you to beat the market but also the easier it is for you to go broke.

Now the question that suggests itself is:

How many different investments do you need to distribute your money over in order to reach your optimal level of diversification?

The answer will depend on your target level of risk and the correlation between the investments you choose.

Correlation refers to the rate at which prices change in relation to each other.

Consider assets A and B.

Positive correlation means when the price of A increases the price of B tends to increase as well.

Negative correlation means when the price of A increases the price of B tends to decrease.

Uncorrelated assets are assets wherein the changes in the price of one gives us no information about the changes in the price of the other.

Positively correlated assets don’t provide much protection since they tend to move in the same direction.

Negatively correlated assets provide some stability to returns but at the cost of your upside since when one asset appreciates the other tends to depreciate.

Uncorrelated assets can reduce your risk without reducing your potential upside and are therefore ideal when diversifying.

Practical Implications of Correlation on Diversification

Consider the following two portfolios, each with 2 stocks:

Portfolio A contains Exxonmobil and Chevron stocks.

Two companies in the oil and gas industry.

Their prices basically move together.

In the above chart, Chevron’s stock price is in Red while Exxonmobil’s price is in Blue.

Notice the price movements of these two stocks are basically identical.

Given the strong correlation between the two stocks contained in Portfolio A, it has very little diversification.

Portfolio B contains Exxonmobil and Sunrun.

Sunrun is a United States-based provider of residential solar electricity.

In the chart above Exxonmobil is in blue whereas Sunrun is in red.

You can see the correlation between these two stocks is less tight than Portfolio A.

In fact, in some instances the correlation may be negative since Sunrun provides solar energy a substitute for Exxonmobil's competing fossil fuel-based energy.

Noteworthy here is that when the economy slowed down for Covid-1 both stocks pretty much tanked.

Therefore while correlation isn't necessarily tight, it isn't zero either.

So even though portfolios A and B each have two stocks in them they do not have the same level of diversification.

The strong positive correlation between ExxonMobil and Chevron left the first portfolio with virtually no diversification at all while the weaker correlation between ExxonMobil and Sunstream left the second portfolio with a non-trivial amount of diversification.

How Many Uncorrelated Assets Do You Need?

Ray Dalio, founder of Bridgewater Associates,one of the largest Hedge funds in the world, wrote a book called "Principles" which I highly recommend you read. In his book he recommends 15 different uncorrelated income streams.

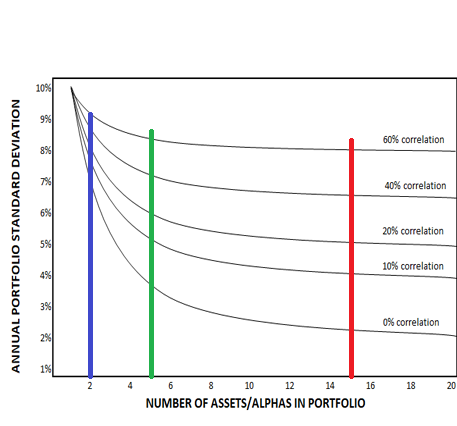

Consider the following graph illustrating the relationship between number of assets, correlation between these assets and risk reduction...

The Red line represents 15 uncorrelated investments. At 0% correlation between these assets the risk of loss in any given year is reduced by around 80%.

The Green line represents 5 uncorrelated investments. At 0% correlation between these assets the risk of loss in any given year is reduced by around 65%.

The Blue line represents just 2 uncorrelated investments. At 0% correlation between these assets the risk of loss in any given year is reduced by around 30%.

Clearly, the biggest bang for your buck (where the slope is steepest downward and you’re reducing the most risk for every asset you add) happens when you first start adding uncorrelated assets. The marginal benefit of adding uncorrelated assets decreases the more assets you add.

While the number 15 may seem reasonable for a hedge fund, I don’t think it is for an individual investor.

Something that does not show up in the chart is the level of knowledge and understanding the investor has about each of the different investments they’ve made.

Understanding your investments is also a key factor in lowering your risk. Perhaps much more than the number of different assets you have or the correlation between them.

My Personal Rule of Thumb

Before I go further I should state the obvious which is that I'm not your financial advisor. This is not meant as financial or investment advice.

As far as diversification, I personally aim for around 3-5 uncorrelated streams of income.

Less than 3 seems too risky.

More than 5 and I'm not sure the benefits of added diversification is worth the additional monitoring and due diligence costs.

By uncorrelated streams of income I'm referring to different asset classes not just different assets.

An example of assets is Tesla stock and Slack stock.

However, both of these assets belong to the same asset class i.e. stocks.

Examples of asset classes are:

- Stocks

- Real Estate

- Commodities

The reason I aim to diversify income across asset classes rather than just assets is because assets that belong to the same asset class tend to have a strong correlation with one another.

The best chance at zero correlation is when you invest across asset classes.

If you just own stocks, you may be able to diversify all the stock-specific risk but you won’t be able to diversify away market risk.

What do I mean by this?

If you had a diversified stock portfolio that mirrored the stock market in February of 2020, when Covid-19 hit, despite being fully diversified as far as stocks go, you still lost 30%-40%.

Summary

Diversification is generally a good thing.

There comes a point however where the marginal benefit of diversification no longer exceeds its costs.

The task of the savvy investor is to walk right up to that point but never pass it.

The effectiveness of diversification depends on a number of factors including: how many different assets you invest in, the correlation between these assets and the quality of your due diligence.

If you’re looking at starting with investing which I highly recommend you do if you have enough cash reserve (never invest what you can't afford to lose) I recommend trying M1 finance.

One of the features of M1 finance is that in addition to taking a portfolio approach to investing and not allowing day trading, since trades can only be placed during certain windows during the day, it also has an automatic rebalancing feature. Every time you add more money to your portfolio it invests that money in a way that brings your stocks' weights back to the targets you've specified for them.

Happy investing.

Leave a Reply