To start our analysis, let’s understand what it means to buy shares or halal stocks in a company.

When you buy shares in a company you are purchasing an ownership interest in that company.

If you buy shares of Apple stock, for example, you are part owner of Apple.

As the owner of a publicly-traded company, there are two primary ways in which you can earn money:

The first is by sharing in the company’s profits through distributions the company may decide to make to its shareholders, these are called Dividends.

The second is if you sell your shares for a price that is greater than the price you bought them.

From a Halal and Haram perspective, there are no violations in either of these methods of earning money i.e. profit distributions from business activity or price appreciation of assets.

Accordingly, since the default for everything in Islam is permissibility, investing in the stock market, in general, is Halal.

5% Limit on Income From Prohibited Activities

The permissibility of profiting from owning a company does, of course, depend on the permissibility of the business activity the company is engaged in.

If the company’s primary business, involves profiting from something which Islam prohibits, then investing in this company is Haram. Examples are companies that sell alcohol, pork, pornography, etc.

That’s an easy call to make.

Like most things, there is some nuance here that needs to be considered.

For instance, what if a company's business involves both Halal and Haram activities? Is it Halal to invest in such a business?

Some commentators have said that the maximum amount of income from Islamically prohibited sources a company can earn is 5% before it becomes prohibited to invest in. [1]

I am not a fan of this approach for a couple of reasons: First, it is very hard to ascertain exactly how much of a company’s income comes from unethical sources. Asking people to calculate the exact percentage of a company's income that comes from unethical sources seems like a rather complex and impractical request to make.

Consider the following example: let’s say you bought shares in a company that sells laundry detergent. Perfectly fine. Let's say during the last fiscal year this company's sales of laundry detergent jumped by 20% while it ran a racy ad to promote their detergent. This jump in sales coincided with a 10% jump in the price of the company's shares at which point you sold your shares.

What percentage of the company's income can you confidently trace back to this racy ad? Can you really say for certain that the jump in sales was caused by the racy ad? Further, can you say that the jump in share price was caused by the increase in sales?

Anything other than a ballpark estimate of income from prohibited activities seems rather impractical and futile when one considers the expected accuracy of such estimations.

The second reason I am not a fan of the 5% limit is that it is a completely made-up number that has no basis in either the Quran or Sunnah.

Coming up with a random number, like 5%, and saying that that’s the limit, doesn’t seem to accomplish anything productive. Quite the contrary, this will simply cause some to suspend common sense in favor of forcing a company’s numbers to fit within this arbitrary limit, which, if you know a bit about accounting, is often not a particularly tough task to do.

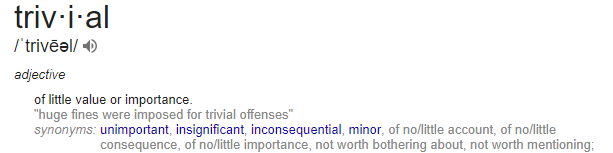

The "Trivial" Rule

My rule of thumb when it comes to investing in companies that have income from both halal and haram activities is the following:

I should be able to describe the portion of the business's income that comes from what Islam considers unethical activities as trivial.

If I think a non-trivial portion of the company's income is coming from unethical activities then I don't invest.

There is no set percentage that defines trivial, but I would argue that: you know it when you see it.

Financial Screens

In addition to the screen related to the nature of a business's activity, there are also financial screens that are often used to designate Halal Stocks or Haram.

While the proposed financial screening criteria differ slightly between different organizations such as the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and FTSE Shariah Global Equity Index Series, they generally revolve around two main themes:

Debt-to-Market Capitalization

The first criteria almost all governing bodies seem to be agreed upon is a comparison between the amount of Interest-bearing debt a company has and the size of the company, typically measured using market capitalization*. [2]

*Market capitalization refers to the total dollar market value of a company's outstanding shares. Commonly referred to as "market cap" it is calculated by multiplying a company's shares outstanding by the current market price of one share. The investment community uses this figure to determine a company's size, as opposed to using sales or total asset figures. [3]

Some have said that the interest-bearing debt-to-market capitalization ratio has to be less than 30% [4] while others have said it must be less than 33.3% [5]. Of course, the reason for this difference of opinion is that neither of these numbers (30% and 33.3%) has any real basis in either the Quran or Sunnah.

I agree that using interest-bearing debt is Haram. If you know my blog or YouTube channel you know that this is a central theme in my articles and videos. Ideally, the tolerable level of interest-bearing debt on a company's balance sheet is 0%.

Unfortunately, nowadays, it’s virtually impossible to find any company that doesn’t deal with interest-bearing debt either as a borrower or a lender at least through holding their cash in interest-bearing financial products.

If we are in agreement, and I think we are, that an exception is being made in pursuit of the greater good, that is, there is greater good in allowing Muslims to invest their money in companies that have limited dealings with interest-bearing debt than there is in not allowing it, if this is the argument, then we should state the argument as such.

We shouldn't tell people that all of a sudden 30% or 33% debt-to-market cap ratios are Halal and above that isn’t because these are totally made up numbers. The only interest-bearing-debt-to-market cap limit with any basis in the Quran or Sunnah is 0%. This is what we can say with 100% confidence.

Tolerating any level of interest-bearing debt above 0% is an exception we are making due to the current ubiquity of interest-bearing debt and determining the tolerable level of dealing with interest is purely based on individual judgment. This is what we should tell people because this is the truth of the matter.

It is logical to expect that the level of tolerance for interest-bearing debt in a company's financials will differ depending on the company being considered.

So for example, I would tolerate a higher level of interest-bearing debt for a company that I knew was close to curing cancer than I would for a video game company.

It doesn’t make much sense to say that a video game company with a 33% debt-to-market cap ratio is Halal to invest in, but a pharmaceutical company that is close to curing cancer and has a debt-to-market cap ratio of 34% isn’t Halal to invest in.

So while it's true that the fewer dealings a company has with interest-bearing debt the better, assigning a rigid acceptable percentage for the debt-to-market capitalization ratio is unproductive and

It's worth mentioning that a low level of interest-bearing debt is not only better from an Islamic Halal and Haram perspective, but it's also better from a financial-risk perspective; companies that have higher levels of debt on their balance sheets are generally riskier investments and should be avoided.

Liquid-to-Illiquid Assets

Aside from the debt-to-market capitalization ratio, one of the criteria that all the governing bodies seem to be agreed upon is the ratio of liquid-to-illiquid assets in a company.

"Liquid" in the context of finance means it can be converted to cash quickly. So the liquid-to-illiquid asset ratio essentially measures how much cash and cash equivalents the company holds when compared to the rest of its assets [6].

The argument is that if the ratio of cash and cash equivalents to assets is too large, some say 50% [7] others say 70% [8], then buying and selling shares in the company should be subject to the same rules as buying and selling money, because that’s basically what the company is made of, and therefore such shares can only be sold at book value, otherwise it is riba.

So if Adam's Widget Service has a balance sheet which consists of $80 cash and $20 widgets, you can only buy shares in Adam's widget service at a valuation of $100 because otherwise, if you buy at a valuation of $120 you are essentially purchasing cash for more than it's face value which is riba. After all, cash is clearly the primary asset on Adam's balance sheet.

I will be polite and only describe this view as missing the mark.

By far, the most important asset for most companies doesn’t ever show up on their balance sheets and this asset is the company’s human capital.

Consider the following example: Two companies are founded today, they both start with exactly $1 million in cash on their respective balance sheets and nothing else. Every single financial ratio you can think of for the two companies is exactly identical.

Company A is owned and operated by Elon Musk, founder of Tesla, SpaceX, The Boring Company and many other extremely successful companies. Company B is owned and operated by Joe Shmoe, who has a 20-year track record of running every company he touches into bankruptcy.

Do both companies have the same value??

Of course not.

It would be pretty darn nuts to give both companies the same valuation and to say that this valuation should be 1 million dollars.

It is entirely rational, given Elon ’s track record, that one would be willing to pay 1 million dollars for only 25% of the business that is owned and operated by him. It would also be entirely rational for an investor to be unwilling to pay $100,000 for %40 of the business that Joe Shmoe is running given his track record of running businesses into the ground. In neither case would either of the investor’s valuations have anything to do whatsoever with riba.

Riba relates to profiting off of loans of money. This is not in play here.

So the criteria of liquid to non-liquid assets is a complete non-factor in anything related to the permissibility of investing in a company at whatever price you choose.

Choosing Halal Stocks: An Alternative Approach

In summary, I don't like the 5% maximum income from Haram activities rule, I don't like the rigid limit on debt-to-market capitalization and I think that constraints on pricing due to the liquid-to-illiquid ratio are silly.

So how do I screen for Halal stocks?

In Surah Al-Baqara, Allah SWT says:

يَسْأَلُونَكَ عَنِ الْخَمْرِ وَالْمَيْسِرِ قُلْ فِيهِمَا إِثْمٌ كَبِيرٌ وَمَنَافِعُ لِلنَّاسِ وَإِثْمُهُمَا أَكْبَرُ مِن نَّفْعِهِمَا وَيَسْأَلُونَكَ مَاذَا يُنفِقُونَ قُلِ الْعَفْوَ كَذَٰلِكَ يُبَيِّنُ اللَّهُ لَكُمُ الْآيَاتِ لَعَلَّكُمْ تَتَفَكَّرُونَ

“They ask you [O’ Muhammad] concerning alcohol and maysir. Say: they contain great sin and benefit for people, but their sin is greater than their benefit. And they ask you what should they give to charity? Say that which is more than you need, and so Allah shows you wisdom so that maybe you will think”

[Quran 2:219]

So Allah SWT is teaching us that in cases where a particular activity has both benefits and harms, good and sin, wisdom entails weighing the good against the bad and deciding accordingly.

Translating this instruction to investing in Halal Stocks, if I'm able to easily describe the revenue the company receives from Haram sources as trivial, I ask myself: Does the company produce more benefit than harm? Another way of asking the same question is to ask: Is the world better off because this company exists or not? If I have a strong feeling that it is, it's Halal to invest in. If I’m not sure or the answer is no, I stay away.

عن النواس بن سمعان الأنصاري قال: سألت رسول الله صلى الله عليه وسلم عن البر والإثم ، فقال: البر حسن الخلق ، والإثم ما حاك في صدرك وكرهت أن يطلع عليه الناس

الإمام مسلم

Al-Nawas bin Sam’an Al-ansari (may Allah be pleased with him) said: I asked the Prophet (peace and blessings of Allah be upon him) about righteousness and wrongdoing, He said:

Righteousness is in good character, and wrongdoing is that which wavers in your soul, and which you dislike people finding out about.

عَنْ وَابِصَةَ بْنِ مَعْبَدٍ الأَسَدِيِّ رضي الله عنه أن النبي صلى الله عليه وسلم قال له : جِئْتَ تَسْأَلُنِي عَنْ الْبِرِّ وَالْإِثْمِ فَقَالَ نَعَمْ فَجَمَعَ أَنَامِلَهُ فَجَعَلَ يَنْكُتُ بِهِنَّ فِي صَدْرِي وَيَقُولُ يَا وَابِصَةُ اسْتَفْتِ قَلْبَكَ وَاسْتَفْتِ نَفْسَكَ ثَلَاثَ مَرَّاتٍ الْبِرُّ مَا اطْمَأَنَّتْ إِلَيْهِ النَّفْسُ وَالْإِثْمُ مَا حَاكَ فِي النَّفْسِ وَتَرَدَّدَ فِي الصَّدْرِ وَإِنْ أَفْتَاكَ النَّاسُ وَأَفْتَوْكَ .

الإمام أحمد

Wabisa bin Ma’bad may Allah be pleased with him said: "I came to the Messenger of Allah (peace be upon him) and he said, 'You have come to ask about righteousness.' I said, 'Yes.' So He, peace be upon him, grouped his fingers and pushed against my chest saying, 'Consult your heart. Righteousness is that which the soul feels at ease with and the heart feels tranquil and wrongdoing is that which wavers in the soul and causes uneasiness in the chest, even if people repeatedly tell you it’s permissible.'"

After being able to describe the income that a company generates from prohibited activities as trivial and estimating that the net impact of a company's activities is positive a final tool of appraisal is to do a gut check, as the Prophet instructed. How is this investment decision sitting with you? Are you Ok with sharing this investment decision with others and making it public?

As an example, let’s say you are invested in a mining company. 100% of its income comes from mining natural resources and it has no debt. Mining and profiting from natural resources is not haram, the company has minimal contact with interest-bearing debt, so the stock is Halal if you just stick to a set of rigid criteria for Halal investments. However, let’s say you know that this particular mining company is causing huge environmental damage in the areas which it operates and it is negatively affecting the health of the populations around its centers of business. If you know this, it is likely that you will not feel comfortable investing in such a company nor will you feel comfortable publicizing your investment and I argue that from an Islamic perspective, you absolutely shouldn’t invest in such a company.

Some may feel uncomfortable with how subjective my approach is and I understand this sentiment. However, it is my belief that before something can be called Islamic it must be supported by the Quran or Sunnah. The only approach that I've found evidence for in the Quran and Sunnah is what I have shared regarding using judgment to compare benefit and harm.

Let me give you an example of my method in action. Take Tesla Motors. Tesla is in the business of producing electric cars, solar panels, and clean energy storage. It's easy to tell that any income it receives from sources other than the products I mentioned is a trivial part of its business. I am also very confident that it is producing way more benefit than harm. Tesla's mission is to accelerate the world's transition to sustainable transport, and I can observe it making huge strides towards this end. I have no problem publicizing that I am invested in Tesla Motors, in fact, I am proud of it. However, if I look at its debt levels, they are quite elevated. Depending on the day you examine Tesla's debt-to-market cap ratio it may not pass the 30% or 33.3% limit. Yet I think it is wrong to say that this causes Tesla stock to become a prohibited investment to make. It is clear to me that the benefit Tesla produces outweighs any harm it has caused by borrowing money and paying interest.

This is not to say that if you are a business owner you should take out interest-bearing loans if you think you will produce more benefit than harm. What I am saying is that in the case of investing in the stock market where you have very limited influence on the decisions that a company is making, and most companies have some amount of interest-bearing debt on their books, I think you are allowed to invest in such companies if you think their output is a net benefit to society.

It is my hope, that if the Islamic Finance Industry starts to offer truly compelling interest-free financing solutions, that have more advantages than interest-bearing debt, there will be enough companies with no dealings with interest-bearing debt that we won't have to tolerate any level of it on a company's balance sheet. At which point we can say, it is only Halal to invest in companies with no dealings with interest-bearing products. However, at this point, making such a claim or assigning a rigid number other than %0 for the tolerable level of interest-bearing debt on a company's financials doesn't seem to offer much value.

Parting Thoughts

So to summarize:

- There is nothing intrinsically wrong with investing in the stock market.

- The primary business of the company you invest in should not run afoul of Islamic teachings.

- The only limit on interest-bearing debt with any support in the Quran or Sunnah is 0%.

- Tolerating any level of interest-bearing debt above 0% is an unfortunate but necessary byproduct of the ubiquity of interest-bearing debt and must be left to judgment based on a best-faith cost-benefit analysis of investing vs. not investing.

- Placing limits on the ratio of liquid-to-illiquid assets is wrong and unnecessary.

- A practical way to figure out if investing in a company is Halal or Haram is to ask the following questions:

- Can I describe the income the company makes from prohibited activities as a percentage of its total income as trivial?

- Is it clear to me that this company causes more benefit than harm?

- Gut check: Do I feel morally comfortable with this investment? Am I ok with publicizing it?

If you answer "no" to any of the above three questions or you are not comfortable in answering them then do not invest.

A byproduct of sticking to my criteria for choosing Halal stocks is that you can only invest in companies whose businesses you understand. I expect that this will likely have a positive impact on your investment performance.

Another matter related to investing in the stock market is Day Trading which I've addressed in the following article.

References:

[1] Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Sharia Standards, November 2017, Page 563

[2] Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Sharia Standards, November 2017, Page 563

[3] Investopedia, Market Capitalization Definition, https://www.investopedia.com/terms/m/marketcapitalization.asp

[4] Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Sharia Standards, November 2017, Page 563

[5] FTSE Shariah Global Equity Index Series, https://www.ftse.com/products/indices/Global-Shariah

[6] Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Sharia Standards, November 2017, Page 567

[7] FTSE Shariah Global Equity Index Series, https://www.ftse.com/products/indices/Global-Shariah

[8] Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) Sharia Standards, November 2017, Page 567

Hi, and thank you for this great article.

I was wondering where do we find that information about the companies regarding debt to markt cap ratio etc... in order to make a decision.

I found so many "shariah" indexes on the internet but nowhere a list of the components of those lists.

Have you tried to invest in saudi arabia markets ?as they tend to have some serious checks regarding halal stocks as well as uae i found this list of halal stocks companies in saudi arabia but i have clue where to find a broker online in order to invest there (https://argaamplus.s3.amazonaws.com/ec19aae7-7367-42ae-ba20-e97e8f0fc761.pdf) the pdf is a list of companies established by sheikh from saudi arabia on saudi arabia companies.

I also tried to look for the listed saudi arabia companies in other markets with no luck.

So my question is how do we find reliable information regarding the criteria that you mentioned ? is there a website referencing all the halal stocks that we can invest in ? is there a known reliable way to invest in uae or saudi arabia ?

Is wirecard halal stock

Asslam walaikum

Based on what you said above on how to pick halal stocks, would you say a company like General Electric would be ok to invest in?

JazakAllah khair in advance

Can I ask my bank, Chase, to invest my money in companies where they are good to humanity? If so, can you email me a list the names of companies that Muslims need to invest in?