In this article, we will see the basics to getting started in the Stock Market.

In order to maximize one’s wealth, one must study what the wealthy do.

If you study the wealthy you’ll notice that they don’t just work in businesses, they are business owners.

It’s one thing to work to make yourself wealthy, it’s an entirely more effective and scalable approach to put yourself in a position where others are working to make you wealthy.

The way to do this is by owning businesses.

Fortunately, we live in a time when owning a business, or a share in a business, has never been easier.

The way to do this is through owning stocks.

So if you want to maximize your chances of joining the ranks of the wealthy it is imperative to familiarize yourself with the basics of stock market investing and that’s exactly what I intend to help you with in this article.

Specifically, in this article I’m going to cover:

- What is a stock?

- How to buy stocks?

- Types of Stocks

- Winning philosophy for picking stocks.

Before I do any of this, it's important to clarify why? that is, why invest in the stock market in the first place...

Why Invest in the Stock Market?

Let's make sure we're absolutely clear about one thing:

The stock market is not the place to go if you want to get rich quick.

After stressing the importance of controlling one’s emotions and showing self-restraint, Allah SWT says:

And none will receive this valuable advice except those who are patient, and none will receive it except those who have a mighty good fortune.

Holy Quran: Surah 41 Ayah 35

Just as having patience, discipline and self-restraint is a good formula for building great relationships with people, it’s also a great formula for building wealth for yourself.

Legendary investor Warren Buffet said: "The stock market is a device for transferring money from the impatient to the patient."

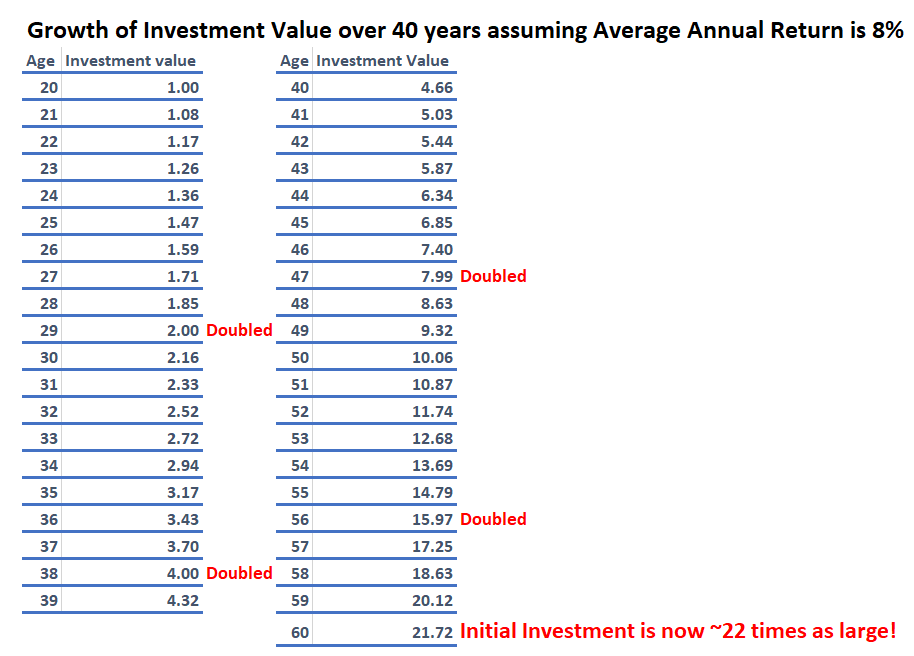

If you look at the last 100 years, the stock market has returned around 8% on average each year. (Remember this is an average. Stock market returns will deviate from this 8% average significantly in any given year).

An 8% annual return means that, on average, every 9 years your investment doubles.

This is rather powerful, but it takes patience to experience its effects fully.

Be prepared for substantial periods where you’re not earning any return or your return is negative.

For example: if you invested all your money in the stock market in December 1999 at the height of the dotcom bubble, it would take you 8 years just to get your money back (That’s why I advise people to not buy all at once and space their investments out over a period of time).

Once you did get most your investment back in September 2007, if you kept your money in the stock market, it would take you yet another 6 years to get it back again after the great recession in 2008.

If you sold after these 13 years over which you got nothing but your money back, you would have missed out entirely on the period of expansion right after where the average return was about 10.5% annually for the next 6 years (and still going as of writing this article).

So the average of 8% is only true for people who generally are in it for the long run.

This means that the younger you are and the earlier you start investing, the more powerful the stock market can be for you as a tool for building wealth.

Protection From Inflation

Another good reason to invest in the stock market is that while it’s good to have a healthy cushion of cash to cover your immediate and medium-range needs, this cash is always losing value because of inflation.

Inflation basically means that a dollar today buys less in goods and services than it did the year before and over time it continuously loses value (On average inflation in the United States is between 2 and 3% a year).

So buying shares in businesses (through stock ownership) is a very effective method of protecting your wealth from the eroding effects of inflation.

So while the business owners see their purchasing power increase every year by 5% (8% average stock return - 3% inflation), the poor who don’t own stocks see their purchasing power decrease by 3% each year. See why the rich get richer now?

What is a Stock?

Let’s say you own a business worth 1 Billion dollars that you’d like to sell. If you try to sell the business as one big chunk you’re going to have a very limited number of potential buyers to choose from and you may or may not be successful in finding a buyer that is willing to give you what you consider a fair price for your business.

On the other hand, if you divide your business into smaller pieces, let’s say 100 million pieces, each one of these pieces with a price of $10 each (keeping the total price for the whole business at $1 billion), everyone with $10 to their name is a potential buyer of a piece of your business. This makes it much more likely that you're able to sell your business for a fair price.

If someone decides to buy one of those 100 million pieces of your business they now become owners of a share of the business, albeit a very small one.

These shares of businesses are also called stocks.

How Can You Buy and Sell Stocks?

The first step is to open a stock market account.

Just like you need a checking account to hold your money you need a stock market account to hold your stocks.

My online stock market account is with a company called Fidelity. There are tons of other options online to choose from.

Here's a handy list of the best online stock market account providers.

Online discount brokers typically charge $5-$10 per trade. I don’t get too caught up in how much a trade costs because I don’t trade frequently. In fact, I think if trades cost $100 per trade people would probably perform better in the stock market since they wouldn’t be so quick to pull the trigger on a buy or sell impulse. More on this in future articles.

Once you’ve chosen your stock market account provider, setting up an account should be free. You'll likely be given the option of opening a cash-only account or a margin account which allows you to borrow money.

DO NOT OPEN A MARGIN ACCOUNT!

For one, margin accounts will charge you interest on any money you borrow which is haram and two, borrowing money to trade in something as volatile as the stock market is super dumb. Don’t ever do this, ever.

Once you’ve opened your stock market account you’ll want to fund the account with some seed money. Typically, you should be able to connect your bank account to your stock market account and transfer money between the two.

The advice here is to start super small. Consider buying a single stock for starters if you have no prior experience with stocks.

Now, let’s talk about the ways you can make money in the stock market.

Types of Stocks

Growth Stocks: are businesses that are in an expansionary phase. You make money with these types of stock by buying at one price and selling at a higher price later.

Income Stocks: pay you Dividends. Dividends are a sum of money paid regularly (typically quarterly) by a company to its shareholders out of its profits (or reserves). Companies that pay dividends typically make more money than there are worthy growth opportunities for them to invest in so they pass along a share of their profits to their shareholders. These are typically more mature, larger companies. E.g. Microsoft.

You may be wondering whether dividends are a form of riba or not: they aren’t.

A quick refresher on riba: for something to involve riba it must include two requisite elements:

- A loan of money.

- A contractual requirement for the financier to a profit.

When you buy a stock, you are not lending any money to anyone since your ownership of the stock does not entitle you to any amount of money in return.

Stock ownership also doesn't entitle you to any profit. Your purchase of stock may turn out to be a losing investment, even if the stock does pay out dividends, because the price of your ownership interest in the stock may decline over time. Additionally, these dividend payouts are at the discretion of the company, the company may decide to lower or discontinue paying out dividends altogether and you would have no right to tell it otherwise.

Now that you know what a stock is, how to buy one, what types of stocks there are, all you need to know is ...

How to Pick Winning Stocks

Everything I’ve said so far is easily understandable and implementable, the much tougher question and the question that will determine whether or not you are profitable in the stock market is: How to find good stocks to buy? And when to sell.

I’m going to go a lot more in-depth about this topic in coming articles but for now, I would like to share with you the following rule that I live by:

I only buy businesses that I understand. Even further, I only buy businesses whose products I use and am a fan of.

When deciding what businesses to buy, ask yourself: What brands am I loyal to, what products do I love? what services do I enjoy?

The answers to these questions will put you on the path to identifying the businesses that make the most sense for you to own.

Value is only half the equation though. The other half is price. Even if you do identify a good business, that business is never worth infinity. There is a price where it's a good buy and a price where it isn't. Pricing businesses is where skill and experience come in. I hope to address the matter of how to price a business in future articles.

I never ever take stock buying tips from people on TV. Stock pickers on TV are only good for entertainment. In fact, in many cases, they serve as great contra-indicators meaning you’d do well if you did the exact opposite to what they recommend.

You may be asking yourself: isn’t the stock market rather risky these days and aren’t most experts predicting that we are going to experience a recession in the not so distant future?

Yes, this is true. In fact, I agree that we are in the later innings of a very good run in the stock market and we will likely experience a downturn over the next 1 or 2 years. No one knows for sure but that’s my hunch.

However, the best time to start investing in the stock market, and to start buying stocks, is during a recession when stock prices are low. That’s when you get the best deals.

Allah SWT says:

It may be that you hate something and it is good for you and it may be that you love something and it is bad for you and Allah knows and you do not.

The Holy Quran Surah 2 Verse 216

On its surface, the recession implies something that is absolutely bad for most, but when one looks more closely they’ll see that it presents many opportunities that I hope to help put you in a position to take advantage of when the time is right.

Remember this golden rule from famous investor Warren Buffett: "Be Fearful when others are greedy and greedy when others are fearful.”

Leave a Reply